Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

EURUSD analysis | German PMI dip pressures EURUSD currency pair

BY Janne Muta

|August 23, 2023The recent cooling of Germany’s economy (EU’s economic powerhouse) has pressured the EURUSD currency pair. The German Manufacturing PMI for August 2023, though showing a slight rise from July, remains in a contractionary zone. Such data has been instrumental in shaping the EURUSD sentiment, particularly the continuous decline over the past fourteen months, which has been heavily influenced by destocking trends and investment reticence. Similarly, the German Services PMI for the same month marked a substantial downturn, with inflationary pressures and rising interest rates casting shadows of uncertainty. Meanwhile, the USD side also paints a compelling narrative. With today’s upcoming release of the US PMI data and the review of previous figures, the EURUSD sentiment could see substantial shifts. The next main risk events for EURUSD currency pair include US Flash Manufacturing PMI, US Flash Services PMI and US New Home Sales.

EURUSD technical analysis

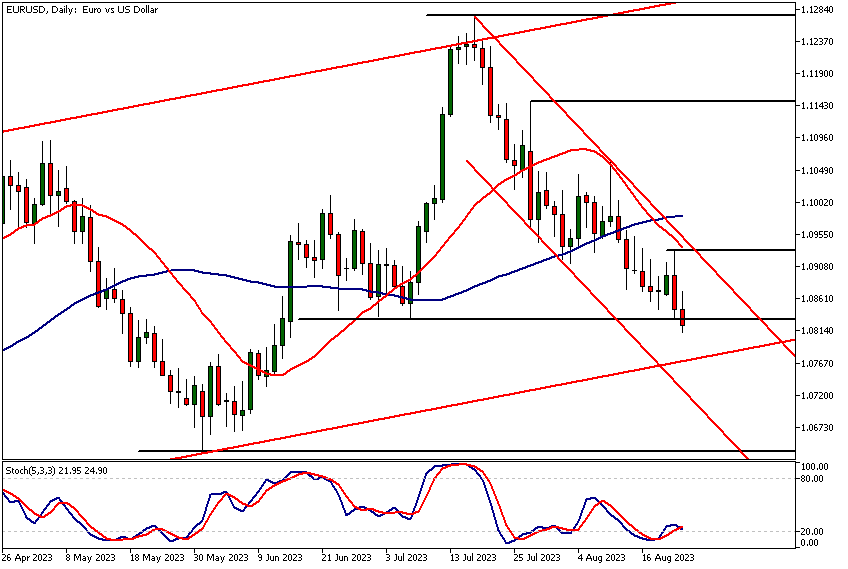

EURUSD weekly chart analysis

EURUSD has been trending higher in a bullish trend channel. Now the latest retracement has brought the market relatively close to the channel low and to a weekly support level that bounced the market to a strong up move in July. The recent down move has brought the market to levels where the Stochastics Oscillator is in oversold territory. The PMI disappointment today has pushed the market slightly below the support level (1.0833).

EURUSD analysis of daily chart

The daily EURUSD analysis shows how the market has been trending lower in a bearish price channel. EURUSD bearish trades have paid off but now the EURUSD currency pair is approaching the long term channel low that could turn the EURUSD bullish again. However, as long as EURUSD sentiment remains bearish traders should follow the price action carefully before making trading decisions on the long side of the market. The nearest key price levels when it comes to EURUSD technical analysis are 1.0833 and 1.0930.

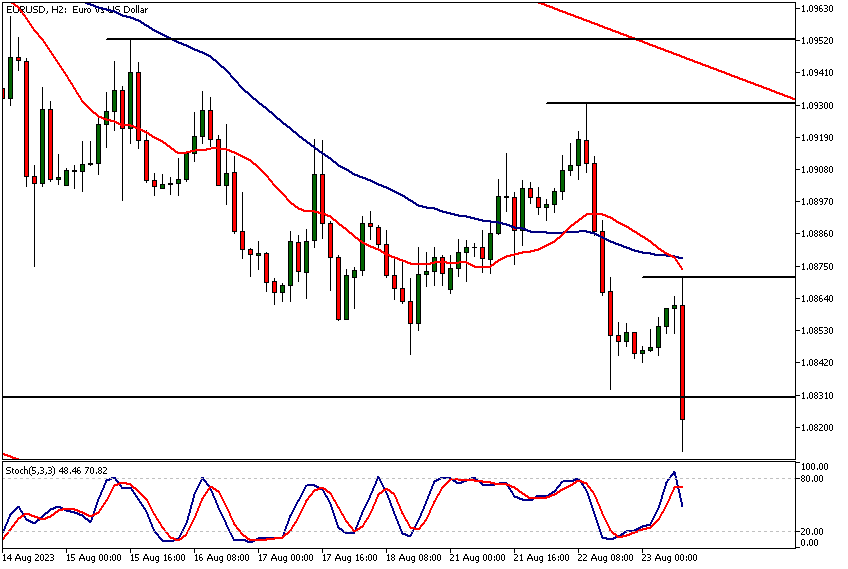

EURUSD, 2h chart technical analysis

The 2h chart reveals the EURUSD bearish move that followed the Germany PMI release. The latest swing high at 1.0871 is an important threshold level in EURUSD chart analysis. While the market remains bearish below the level, a strong rally above it could move EURUSD currency pair to 1.0900.

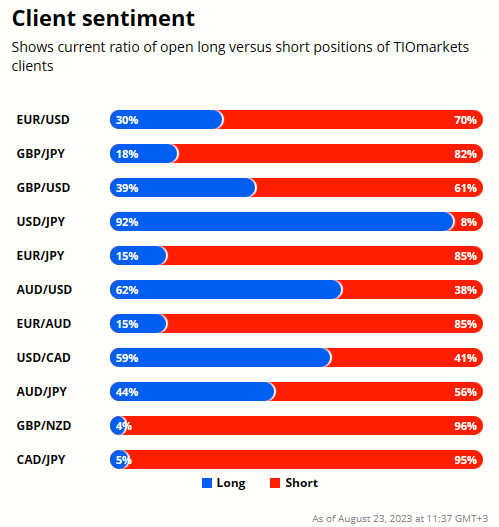

Client sentiment analysis

TIOmarkets' clients are mostly bearish on EURUSD as 70% of the clients are short . It’s good to remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

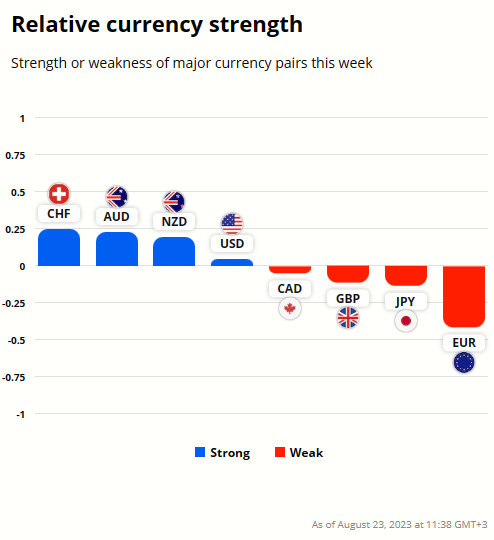

EUR and USD relative currency strength

After the disappointing German PMI report today the EUR traded lower and is now the weakest currency among the major dollar rivals while CHF is the strongest.

EUR fundamental analysis

German manufacturing sector and its influence on the EURUSD currency pair

The Germany Manufacturing PMI data for August 2023 indicates a slight respite, showing a value of 39.1, up from the three-year low of 38.8 in July. However, this remains embedded in the contractionary zone. The EURUSD sentiment might be heavily influenced by this continuous decline, marking the fourteenth consecutive month. The driving forces behind this decline include destocking trends and a significant investment reticence, leading to the steepest drop in new orders since May 2020. These developments compound consumer uncertainty and the looming shadow of rising interest rates, explaining the recent EURUSD bearish sentiment. Interestingly, despite these challenges, the EURUSD investing landscape saw only a marginal decrease in employment, and manufacturers' purchasing prices showed a gentler decline than the previous month. With goods producers hinting at a minor uptick in optimism for the future, there's a possibility of a EURUSD bullish sentiment emerging later on.

German services sector and its reflection on EURUSD analysis

The Germany Services PMI for August 2023, standing at 47.3, is a significant downturn from July's 52.3. This is a substantial deviation from market expectations. The EURUSD analysis today highlights the impact of this contraction. The decline in the PMI index the most substantial since November 2022. The underlying causes include client hesitancy and constricted household and corporate budgets due to rising interest rates and inflationary pressures. Such dynamics could lead to a EURUSD sentiment of caution among investors. With the sharp decline in new business and exports, the EURUSD chart analysis might depict a period of stagnation or even a downturn. However, the silver lining is the controlled inflationary pressures and a restrained yet positive outlook from service companies.

EURUSD analysis, impact of German trends on EURUSD current price

Given the economic trends in Germany, it's essential to assess the potential reverberations on the EURUSD currency pair. Based on the EURUSD analysis, the market sentiment seems to be bearish after the figures were released. The German economic trajectory might introduce further bearish sentiment on the EURUSD. However, the broader EURUSD investing landscape might present bullish opportunities, contingent on global economic shifts and ECB's policy adaptations. For traders, the EURUSD current price is a crucial metric, and an in-depth EURUSD chart analysis will be instrumental in guiding trading decisions.

For more EUR analysis visit our recent EURAUD analysis report.

USD fundamental analysis

Anticipating the USD PMI data release

As we gear up for today's release of the S&P Global PMI data for July 2023, we'll study what to expect and the broader implications of the data releases. This will complement the EURUSD chart analysis provided above. Traders and investors are keenly following whether we might see increased volatility and more trading opportunities after the data release.

Review of previous PMI figures and EURUSD sentiment

In June, the Manufacturing PMI stood at 49, reflecting a marginal contraction in the sector, though it's the softest decline in three months. The Services PMI, on the other hand, showed a decline to 52.3, pointing towards the slowest growth rate in the services sector in five months. If today’s release shows further contraction we could see EURUSD sentiment turning more positive.

Factors turning EURUSD bearish in July

Several factors appear to be contributing to these trends. On the manufacturing front, muted domestic and external demand conditions are evident, with new orders continuing their decline. A challenging sales environment has led to a reduction in input buying and a sharp depletion of inventory holdings. The EURUSD sentiment turned bearish in July mirroring this. Interestingly, despite these headwinds, employment in the sector has expanded, reflecting optimism about future output.

Challenges in the services sector and implications for the EURUSD currency pair

In contrast, the services sector, which accounts for a significant portion of the US economy, is facing headwinds from high interest rates. This has reportedly impacted domestic consumer spending, slowing down business activity and new order rates. While new export business has risen, the overall outlook for the sector appears less than optimistic, with the least upbeat expectations for the coming year recorded so far in 2023. The composite PMI, which combines both manufacturing and services data, declined to 52, marking six months of expansion, albeit at declining rates. The services sector's resilience seems to be counterbalancing the manufacturing sector's contraction. Rising interest rates seem to be a key factor weighing down consumer spending, affecting both sectors.

The Fed's dilemma and considerations for EURUSD analysis today

Considering these trends, the Fed might find itself in a complex situation. The pressure from rising input prices, especially due to sharp hikes in service-sector wages, indicates underlying inflationary pressures. Typically, this would warrant a tightening of monetary policy. However, with key sectors showing signs of slowing down, an aggressive tightening stance might exacerbate the slowdown. Those focusing on EURUSD analysis today would be wise to keep these factors in mind as continued hawkishness from the Fed might lead to further decline in EURUSD. It's therefore likely that the Fed could keep the rates high for longer than the market operators expect and will adopt a wait-and-see approach, closely monitoring subsequent data releases. Any future policy decisions would need to strike a delicate balance between curbing inflation and supporting growth.

For more USD analysis visit our USDCAD analysis report.

The next main risk events

- CAD Core Retail Sales

- CAD Retail Sales m/m

- USD Flash Manufacturing PMI

- USD Flash Services PMI

- USD New Home Sales

For more information and details see the TIOmarkets economic calendar.

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.