Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

EURAUD up as China worries pressure AUD

BY Janne Muta

|August 22, 2023EURAUD has been trending higher as the AUD has suffered from the slowdown in the Chinese economy. The Eurozone has shown resilience in the face of mild economic downturns, and there are expectations of growth in the upcoming years. While there are concerns, notably with the ECB's expected hawkish stance which may impact growth rates, the overall sentiment seems cautiously optimistic. The Australian economy on the other hand is impacted by China's economic health due to their substantial trade relationship.

The downturn in China's industrial, export, and manufacturing sectors, along with the potential ineffectiveness of PBOC's measures to stabilize the yuan, could significantly affect the demand for Australian commodities, placing downward pressure on the AUD. This explains the bullish trend in EURAUD. The Eurozone and Germany, despite challenges, present a more stable economic outlook compared to the uncertainties facing Australia due to China's economic slowdown. The next key risk events impacting EURAUD are German Flash Manufacturing PMI and German Flash Services PMI on Wednesday.

EURAUD technical analysis

EURAUD weekly chart analysis

In the weekly chart, EURAUD is trading above a key support level (1.6786) but also relatively close to the next weekly resistance level (that coincides with the channel high. The market is also overbought as per Stochastics Oscillator but that's common in uptrends and should be treated as a secondary indicator to the price action itself. Should there be a retracement to the support we might see renewed buying interest in the market.

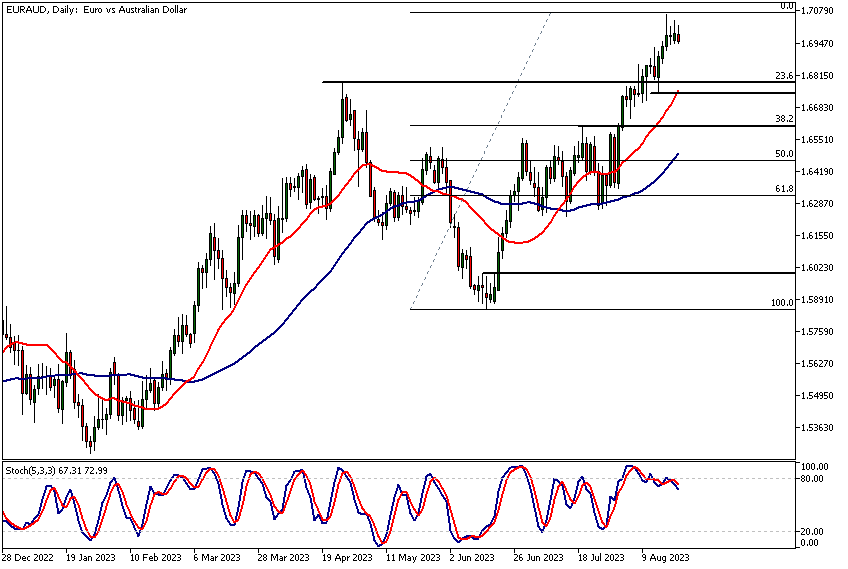

EURAUD analysis of daily chart

EURAUD has been rallying strongly since breading above the 1.6600 level. Now the pair has lost some momentum in the daily chart with three daily candles all being inside candles. This could lead to a retracement that could possibly take the market down to a technical confluence area at 1.6740 - 1.6786. This is where the 23.6% Fibonacci retracement level, a recent penetrated resistance (now support) and the 20-period SMA coincide. A successful test of the level could attract further buying that could lead to a continuation of the trend. If however, the support area doesn't hold we might see a move down to 1.6560.

EURAUD, 4h chart technical analysis

A lower high at 1.7039 indicates short-term weakness in the market. If the 1.6944 support breaks, the market might move to 1.5865 or so (measured move projection). In technical analysis, measured move targets are normally considered as first targets and therefore it’s also possible that the market could trade to the confluence area (1.6740 - 1.6786). Either way by following price action we can identify opportunities on both sides of the market. Remember though that as long as the market remains in an uptrend it’s more likely to move higher. As always, trading what we see the market doing is more likely to provide us with an edge. Some traders fight the market trying to impose their own beliefs and ideas on it and end up having rather difficult careers as traders.

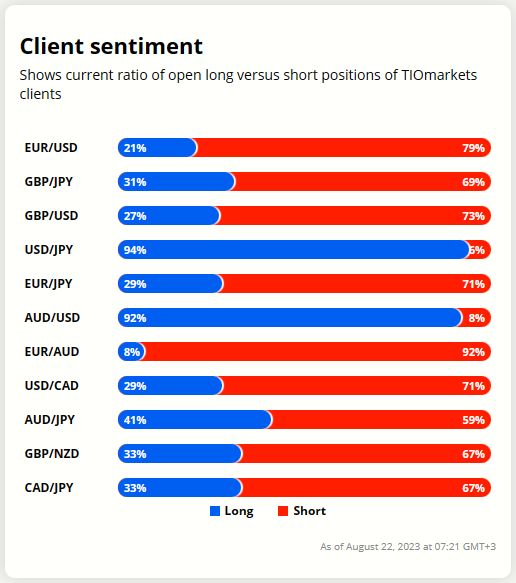

Client sentiment analysis

TIOmarkets' clients are mostly bearish on EURAUD. Only 8% of clients are currently holding long positions in the market. It’s good to remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

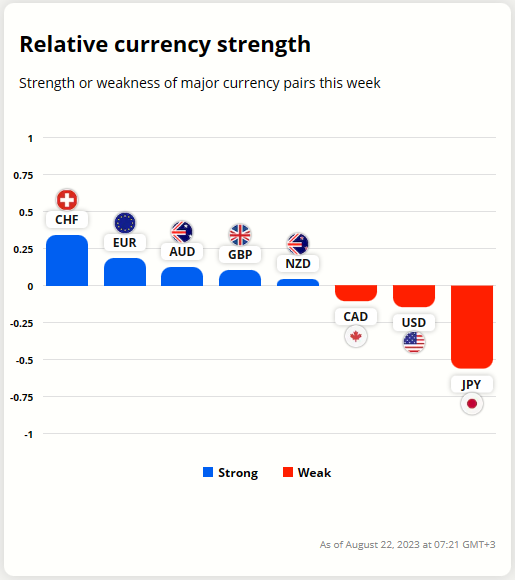

EUR and AUD relative currency strength

There's hardly any divergence in the performance between AUD and EUR this week. Over the last nine weeks, however, the pair has rallied about 7%.

EUR fundamental analysis

The Euro area's economic activity has exhibited a mild decline but has proved resilient to major supply shocks. Despite challenges, growth is anticipated in the coming years, driven by factors like moderating energy prices, stronger foreign demand, and the resolution of supply bottlenecks. A robust labour market is set to support real incomes, paving the way for economic recovery. However, the European Central Bank's (ECB) monetary policy tightening is expected to start influencing the real economy, suggesting a hawkish stance in the near term. The main objectives are curbing inflation and stabilizing an economy that might be overheating. While tighter credit supply conditions could limit growth, the ECB's measures are also anticipated to dampen underlying inflation. Real GDP growth is projected to slow to 0.9% in 2023, down from 3.5% in 2022, before accelerating to 1.5% in 2024 and 1.6% in 2025. Inflation remains a concern; although energy prices are dropping, headline inflation is predicted to decrease from 8.4% in 2022 to 5.4% in 2023, and then to 2.2% by 2025. The overarching narrative is of an ECB geared up to manage inflation and stabilize the economy, albeit with potential impacts on growth rates.

Germany is the Eurozone's largest economy, influencing the overall region's economic health. Its trade dynamics, stability, and significant contribution to the Eurozone's GDP make its economic data crucial for assessing fundamentals impacting the EUR. The ECB also monitors Germany closely when making key monetary policy decisions. We will therefore take a closer look at the recent German economic trends.

Labour Market Dynamics

Germany witnessed a notable drop in unemployment figures in July 2023. The number of unemployed individuals decreased by 4.0 thousand, settling at 2.604 million. This decrease brought the unemployment rate down to 5.6%, a figure more favourable than market expectations. Yet, there is an underlying concern. Excluding Ukrainian nationals from the count, the report indicates a potential increase in the jobless figures attributed to the challenging economic environment. Compared to the previous year, the total unemployed populace has risen by 147,000. Reflecting on this, Labour Office head Andrea Nahles aptly remarked, "Companies' demand for labour remained restrained." This statement is further corroborated by the fact that there were 108,000 fewer job openings in July 2023 than a year ago, totalling 772,000.

Manufacturing Landscape

The health of the German manufacturing sector, often a reliable barometer of its overall economic vitality, is facing headwinds. The HCOB Germany Manufacturing PMI in July 2023 slid down to its lowest reading since May 2020, standing at 38.8, pointing to deteriorating business conditions in the sector. Factors contributing to this decline include a significant drop in new orders, economic and geopolitical uncertainties, and tighter financial conditions. Notably, manufacturers have started scaling back production and are gradually making inroads into their backlogs of work.

Trade Dynamics and Industrial Indicators

Germany’s trade surplus exhibited growth, broadening to €18.7 billion in June 2023. This growth comes on the heels of a decline in imports by 3.4% and a slight increment in exports by 0.1%. A more in-depth look at the numbers reveals that while exports to EU countries showed growth, sales to non-EU countries, including significant trading partners like the US, China, the UK, and Russia, were on the decline. Despite these contrasting dynamics, Germany recorded an increase in total exports to 131.55 EUR Billion in June 2023.

Factory orders, against market expectations, swelled by 7% month-over-month in June 2023. This growth marks the third consecutive month of a surge in industrial orders, primarily fueled by large-scale orders in several areas, including mechanical engineering and aerospace-linked vehicle construction.

Inflation Concerns and Economic Sentiment

The annual inflation rate in Germany eased slightly to 6.2% in July 2023. Although this indicates a cooling down of inflationary pressures, the rates still loom significantly above the European Central Bank's target. A specific sectoral breakdown shows that the inflation for goods and services both slowed, but energy inflation picked up pace. Interestingly, the producer prices reflected a stark decline, marking a drop for the first time since November 2020. Lastly, the ZEW Indicator of Economic Sentiment for Germany presented a minor relief, increasing to -12.3 in August 2023 from -14.7 in July. This rise signifies cautiously optimistic anticipation from financial experts regarding a potential uptick in Germany’s economic situation by the year-end.

AUD fundamental analysis

The People's Bank of China (PBoC) reduced its 1-year loan prime rate (LPR) by 10 basis points, setting a new record low at 3.45%. Surprisingly, it has kept the 5-year rate, which serves as a mortgage benchmark, unchanged at 4.2%. This move comes on the heels of last week's unexpected cuts in both short-term and medium-term lending rates by the central bank. Their strategy appears to be a nuanced one: reviving a struggling economy while preventing the yuan from weakening further.

The recent economic tremors emanating from China concern investors and economists alike while impacting the Australian economy the most. As key data reveals a faltering Chinese industrial output, a stark decline in exports, and a contraction in manufacturing activity, Australia's tight trade relationship with China raises questions about the sustainability of Australian economic growth.

The intertwined economies of the two nations mean that China's downward trajectory could exert significant downward pressure on the AUD. Given the potential reduced demand for Australian commodities in the face of China's economic headwinds we might see the Australian economy also slowing down. In this article, we take a closer look at the recent economic trends in China to gain a better understanding on the potential challenges ahead for the Australian dollar. China has long been considered the engine for global growth. But as recent data reveals, a confluence of unsettling economic signs from China is stirring concern. The repercussions of these shifts, especially for nations like Australia with significant trade links to China, are profound.

China's Economic Indicators

Key market indicators, such as the bearish trend of Hong Kong’s Hang Seng Index and the Chinese yuan trading near the lowest levels in 16 years, emphasize the depth of China's economic slowdown.

PBoC's Moves

While the PBoC has intervened with a cut in its 1-year loan prime rate to a record 3.45%, it held the 5-year rate, a mortgage reference, at 4.2%. This move seems to be a calibrated approach, balancing the need to support the economy while preventing further yuan depreciation.

Declining Industrial and Export Activities

China's industrial output has shown signs of faltering momentum. It grew by just 3.7% year-on-year in July 2023, falling from June's 4.4% and not meeting the expected forecasts. Most concerning, however, has been the stark decline in exports. A significant 14.5% year-on-year drop to USD 281.76 billion in July 2023, marking the most considerable decline since the early days of the pandemic in February 2020. When we parse this data, a decline of 23.1% in exports to the US and sharp drops to ASEAN countries and the EU by 21.4% and 20.6%, respectively, are evident.

Manufacturing Setbacks

Moreover, the Caixin China General Manufacturing PMI descended to 49.2 in July 2023 from 50.5 in June, signalling a contraction in factory activity. This index's dip reflects a decrease in new orders, a contraction in foreign sales, and competitive pricing strategies leading to decreased output charges.

Implications for the Australian Dollar

Australia's relationship with China is fundamentally economic. The significant declines in Chinese exports, especially the considerable 23.1% reduction to the U.S., can potentially reverberate into a reduced demand for Australian commodities, given the interconnected nature of global trade.

If China's current trajectory, as depicted by declining industrial production, faltering exports, and manufacturing contraction, continues, the demand for Australian commodities like iron ore, coal, and natural gas could see a downturn. This scenario will inevitably exert downward pressure on the AUD. Furthermore, China's PBoC's policy measures, aimed primarily at economic rejuvenation and yuan stability, will also eventually influence the AUD's value. An inability of these measures to stem the yuan's decline might trigger capital outflows, favouring safe-haven currencies and potentially pushing the AUD downwards.

The next main risk events

- USD Existing Home Sales

- USD Richmond Manufacturing Index

- NDZ Retail Sales

- EUR French Flash Manufacturing PMI

- EUR French Flash Services PMI

- EUR German Flash Manufacturing PMI

- EUR German Flash Services PMI

- EUR Flash Manufacturing PMI

- EUR Flash Services PMI

- GBP Flash Manufacturing PMI

- GBP Flash Services PMI

- CAD Core Retail Sales

- CAD Retail Sales m/m

- USD Flash Manufacturing PMI

- USD Flash Services PMI

- USD New Home Sales

For more information and details see the TIOmarkets economic calendar.

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.