Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Economic divergence rallies USDCAD

BY Janne Muta

|August 21, 2023Economic divergence rallied USDCAD but is the trend going to last? The pair has been rallying for three consecutive weeks. The strength can be attributed to contrasting economic signals from both economies. While the US shows signs of resilience in the services sector and the strength in the economy indicates the Fed could keep the rates at relatively high levels for longer. At the same time, Canada grapples with trade imbalances, a concerning decline in exports, and manufacturing contraction. The next key risk events for the USD and CAD are: US Existing Home Sales and Richmond Manufacturing Index today and Canadian retail sales tomorrow.

USDCAD technical analysis

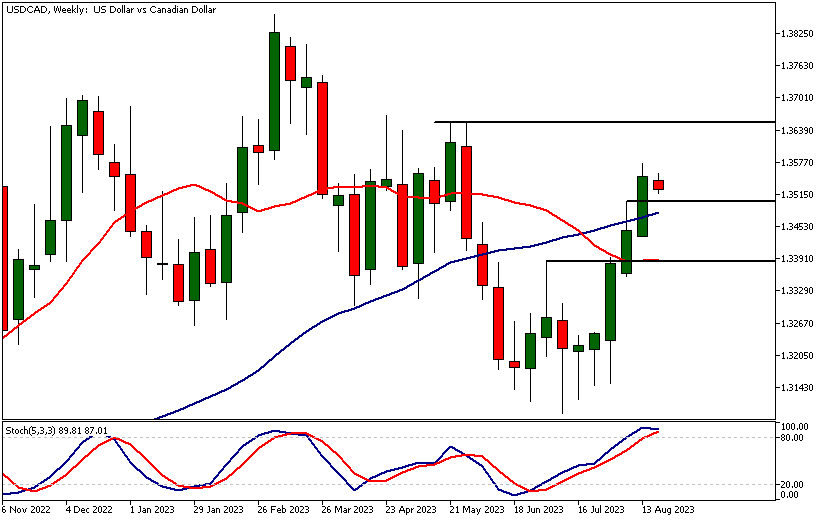

USDCAD weekly chart analysis

USDCAD has rallied 2.4% in three weeks. The strong momentum in the weekly chart suggests the market, even though it’s overbought as per Stochastic Oscillator (5.3.3.), could rally further. The next major resistance level is at 1.3667 so there still might be upside potential in this market. The level is about 0.9% away from the current market price.

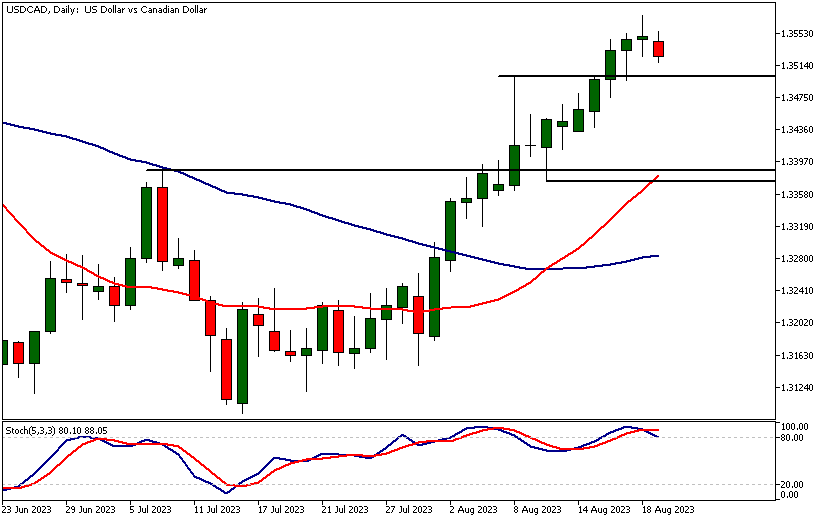

USDCAD analysis of daily chart

The daily chart reveals some loss of momentum. Friday’s trading wasn’t able to produce another momentum day. Instead, the market closed not far from the opening levels. The market remains bullish above 1.3500. Below the level, the risk of further correction would increase.

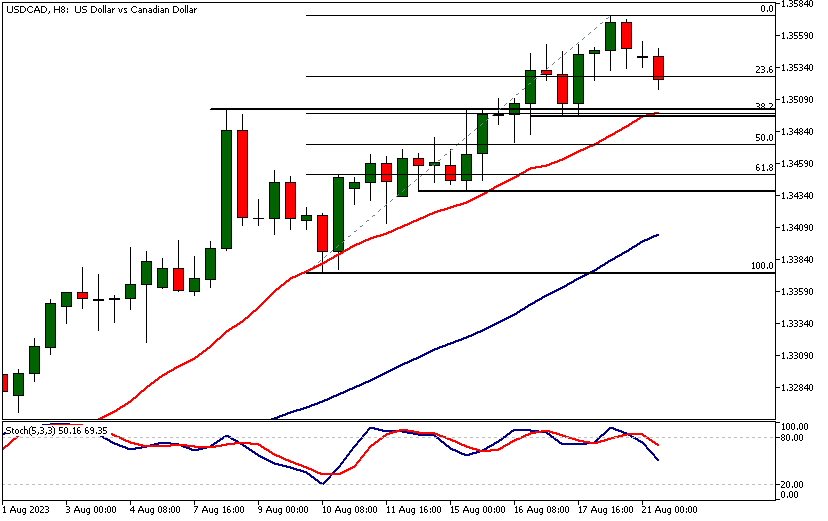

USDCAD, 8h chart technical analysis

A recent market structure level, the 38.2% Fibonacci retracement and the SMA(20) in the 8h chart coincide at the 1.3500 level. This technical confluence adds to the significance of the level. If the level is strong enough to bounce the market higher after a potential price retracement, we could see the market rallying towards the next major resistance level at 1.3667. Below 1.3500, a move to 1.3380 might take place.

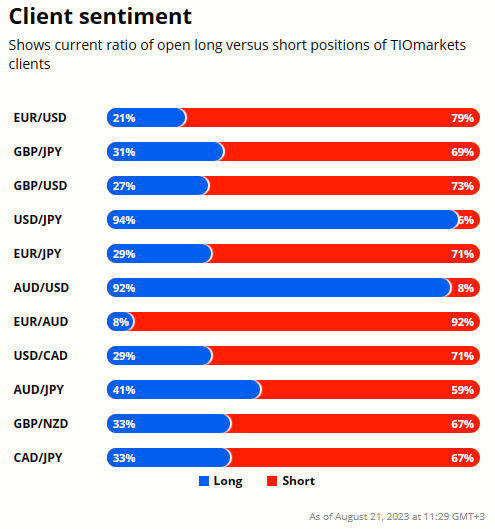

Client sentiment analysis

TIOmarkets' clients are mostly bearish on USDCAD. The majority, 71% of clients are currently holding short positions in the market. It’s good to remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

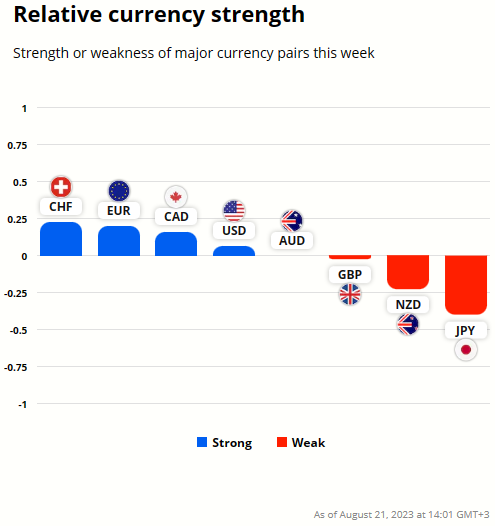

USD and CAD relative currency strength

There hasn’t been significant movement in USD and CAD yet as it’s early in the week. Over the last three weeks, however, USD has strengthened 2.4% against its Canadian counterpart. Over the same time period only AUD, NZD and JPY have been weaker than the CAD.

USD fundamental analysis

The US economic landscape is characterised by contrasting signals, suggesting both resilience and potential vulnerabilities. The manufacturing sector, as evidenced by the Philadelphia Fed Manufacturing Index, shows early signs of recovery, but employment within the sector paints a less favourable picture. While the services sector hints at softening growth due to high interest rates impacting domestic spending, a surge in orders for durable goods underscores renewed business confidence. At the same time, consumer sentiment remains cautious due to Fed's hawkish stance, heightened borrowing costs, and ongoing concerns about inflation. This reflects in the US labour market in falling job openings and underwhelming job creation while the unemployment rate stays low. Personal financial metrics indicate possible financial strain, with spending outpacing income growth. The US economy, while showing signs of robustness in certain sectors, remains threatened by underlying challenges.

Services Sector: Slowing Growth

While the services sector remains in expansionary territory, there are clear signs of caution and challenges ahead. The slight downward revision of S&P Global US Services PMI for July to 52.3, marking the weakest expansion in half a year suggests the growth momentum is slowing down. This is possibly due to the dampening effect of high interest rates on domestic spending. While internal demand seems to have softened, the sector finds some respite in the rising export business, which has bolstered overall sales. This external demand, however, hasn't translated into significant employment opportunities, as hiring remained muted.

Moreover, the subdued rise in input costs contrasts with the faster pace at which firms increased their output charges, indicating potential margin improvements or cost pressures elsewhere. A notable concern is the dampened sentiment among services firms, reflecting the least optimistic output expectations for the upcoming year as of 2023.

Durable Goods: Indication of Business Confidence

On a brighter note, the surge in new orders for US-manufactured durable goods is encouraging. A jump of 4.7% month-over-month in June, the most impressive since July 2020, underscores a rebounding demand for capital-intensive products. Such an uptrend in capital goods, machinery, and electronics orders underlines businesses' expectations for future growth and their willingness to invest.

Consumer Sentiment: Economic Improvements with Inflation Concerns

Yet, this sense of optimism needs to be balanced with the University of Michigan's consumer sentiment. While it edged slightly lower in August, the year-ahead inflation expectations marginally declined. This suggests that while consumers acknowledge economic improvements, their long-term outlook remains tethered by concerns about rising prices, thereby potentially tempering future consumer spending.

Federal Reserve's Stance: Balancing Act Between Growth and Inflation

The Federal Reserve's hawkish stance, illustrated by the recent rate hike, brings borrowing costs to levels not seen since the turn of the millennium. Such a decision underscores the Fed’s ongoing concern about inflationary pressures. While this might appease those worried about an overheating economy, it also risks putting further downward pressure on sectors sensitive to interest rates, such as housing. Indeed, the House Price Index's YoY decrease in May hints at this very scenario.

It’s notable though that the markets anticipate a pivot in the Fed's direction. Rather than continuing on a path of rate hikes, Fed Fund Futures traders are betting on the Fed cutting rates in May next year.

Labour Market Dynamics: Nearing Capacity?

The labour market offers another layer of complexity. The recent decline in job openings, reaching the lowest level since April 2021, coupled with an underwhelming number of jobs (187K) created in July, suggests a potential cooling off. However, this needs to be seen against an unemployment rate that continues its downward trajectory, indicating a tight labour market. While a lower unemployment rate is usually a sign of economic health, in conjunction with fewer job openings and sluggish job creation, it could also suggest that the labour market is nearing its capacity.

Personal Financial Health: Are Consumers Overstretching?

Personal income and spending metrics provide another lens through which the economy's health can be gauged. While personal income growth has shown a deceleration, personal spending, especially on services, has remained relatively strong. This disparity hints at consumers tapping into savings or leveraging credit, a trend which, if sustained, could lead to future financial vulnerabilities.

Inflation: A Lingering Concern for investors

Inflation continues to pose a challenge. The Core PCE prices indicate a slight easing of inflationary pressures on a month-over-month basis. Yet, the backdrop of rising input prices in sectors, coupled with the Federal Reserve's expressed concerns about high inflation, means traders should not exclude the possibility of the Fed keeping the rates high for longer.

CAD fundamental analysis

Inflation Surge: Energy Prices and Mortgage Interest at Play

In July, the inflation rate in Canada climbed to 3.3% from 2.8% the previous month, outpacing the market's expectations. This was propelled by the reduced decline of energy prices—primarily gasoline—owing to a base-year effect and accelerated electricity prices. The mortgage interest cost index showcased another record year-over-year surge, acting as the predominant contributor to this inflation uptick.

Balancing Act: Some Sectors Resist Inflationary Pressures

Simultaneously, certain segments saw price deceleration or decline, notably groceries, traveller accommodation, natural gas, and airfares. These downward shifts signal a possible balance in inflationary pressures as not all sectors are moving in the same direction. A look into the core inflation, which omits volatile sectors like food and energy, showed a consistent 3.2% for two consecutive months. This consistency amidst the general inflationary environment is likely to be a more indicative measure for the central bank to base its interest rate decisions on.

Trade Deficit Concerns: Falling Exports and Economic Implications

Exports, a crucial component of Canada's economic machinery, have depicted a concerning trend. In June 2023, Canada recorded a trade shortfall of CAD 3.73 billion, surpassing market projections of CAD 2.90 billion and exceeding the previous month's revised CAD 2.68 billion deficit. This widespread decline across product sections, notably in critical sectors such as metals and mining products, combined with a significant fall in sales to major trading partners like China and Germany, herald potential challenges for the trade balance.

A Widening Trade Gap: Imports and Exports Diverge

Adding to the trade-related challenges, Canada's trade deficit widened in June, marking its most significant gap since late 2020. While exports dwindled to a near one-and-a-half-year low, imports showed a moderate decline, heavily influenced by reduced acquisitions of energy products and pharmaceuticals.

Economic Activity

The Ivey Purchasing Managers Index signalled a contraction in Canada's economic activity in July, breaking six months of growth. Slower job creation, declining inventories, and an acceleration in prices reflect tightening market conditions. Canada's manufacturing sector, a significant pillar of the economy, too faces headwinds. The PMI recorded a third month of contraction in July, mirroring the broader downturn in North America, with market uncertainties and high borrowing costs weighing down factory activity.

Bank of Canada's Dilemma: Hawkish or Dovish?

Given this economic tableau, the Bank of Canada (BOC) might find itself in a delicate balancing act. On the one hand, the inflationary pressures and robust core inflation could warrant a hawkish stance, nudging the central bank towards a potential interest rate hike, particularly if the goal is to cool down the overheating segments of the economy.

Retail Sales Trends: Awaiting New Insights

The retail sales data released on Wednesday this week will shed more light on retail sales trends in Canada. The economy experienced a significant boost in full-time employment in June. However, this job growth hasn't necessarily translated into robust retail sales yet, which have been somewhat stagnant and volatile over the first five months of the year.

The next main risk events

- USD Existing Home Sales

- USD Richmond Manufacturing Index

- NDZ Retail Sales

- EUR French Flash Manufacturing PMI

- EUR French Flash Services PMI

- EUR German Flash Manufacturing PMI

- EUR German Flash Services PMI

- EUR Flash Manufacturing PMI

- EUR Flash Services PMI

- GBP Flash Manufacturing PMI

- GBP Flash Services PMI

- CAD Core Retail Sales

- CAD Retail Sales m/m

- USD Flash Manufacturing PMI

- USD Flash Services PMI

- USD New Home Sales

For more information and details see the TIOmarkets economic calendar.

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.