Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

EURUSD technical analysis | EURUSD trades at bullish channel low

BY Janne Muta

|August 29, 2023In today's report, we cover not only the EURUSD technical analysis but also the recent economic data releases from both sides of the Atlantic.

The German economy, a principal player in the Eurozone, continues to exhibit pronounced weaknesses in both the manufacturing and services sectors, as indicated by the recent PMI figures.

On the US front, Federal Reserve Chair Jerome Powell's recent speech signalled a possibility of future interest rate hikes but left room for a hold in the upcoming September meeting.

Additionally, a downward revision in the University of Michigan's consumer sentiment index further underscores the cautious stance on inflation and the economy both from policymakers and consumers.

Interestingly, the EURUSD pair traded higher post-Powell's speech, suggesting market participants might be pricing in both the German economic weaknesses and a potential Fed rate hike in November.

The next key risk events for EURUSD market are S&P/CS Composite-20 HPI, CB Consumer Confidence, JOLTS Job Openings and German Prelim CPI.

Read the full EURUSD technical analysis below.

EURUSD technical analysis

EURUSD weekly chart analysis

EURUSD reached the bull channel low last week and has now bounced a bit from the trendline support. We highlighted this possibility last week in our EURUSD technical analysis report.

The Stochastics Oscillator (5.3.3) is below the oversold threshold and might give a bullish signal, provided that EURUSD keeps on reacting higher from this support. Remember though, that indicators are derivatives of the price action itself. Therefore, it’s the price that dominates what indicators indicate, not the other way around.

In order to turn around the market needs to push back above the June low (1.0835) and show ability to attract new buying above the level. The next challenge after this will be the weekly high that coincides with the SMA(20) at 1.0930. If the market clears these obstacles, it is likely to resume the weekly uptrend.

Daily EURUSD technical analysis

The daily timeframe chart reveals an inside candle after the market reacted to our bull channel low on Friday. Undoubtedly, this trendline support was recognised not only by us but also by the institutional traders. Retail traders cannot turn a market higher if the institutional supply keeps on pressuring EURUSD lower.

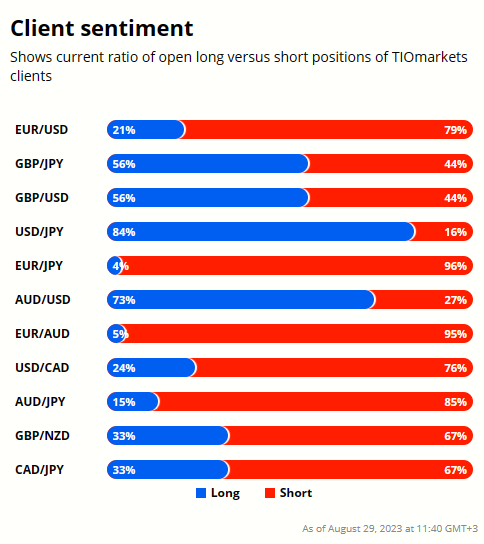

Therefore, it is possible that Friday’s bullish reaction and the inside candle on Monday were created with the institutional money starting to flow into EUR. Judging from the TIOmarkets client sentiment indicator, this might have been the case as the retail crowd is still heavily short EURUSD.

It is worth pointing out though that what we are seeing in EURUSD price action now is still only early indications of a possible trend reversal. The market needs to show more strength on the long side before we can conclude that institutional fund flows are likely to drive the market higher.

At the time of writing this, the market is trading at the June low (1.0833). If the level is cleared EURUSD technical analysis hints the market might test the daily timeframe confluence area around a market structure level 1.0875. This is where the daily bear channel high, the 23.6% Fibonacci retracement level coincide with the market structure level.

A successful breakout above this area could take the market to the 50% Fibonacci retracement level at 1.1021. A failure to penetrate the area would keep the market in the bearish price channel and could push it towards Friday’s low (1.0766) again.

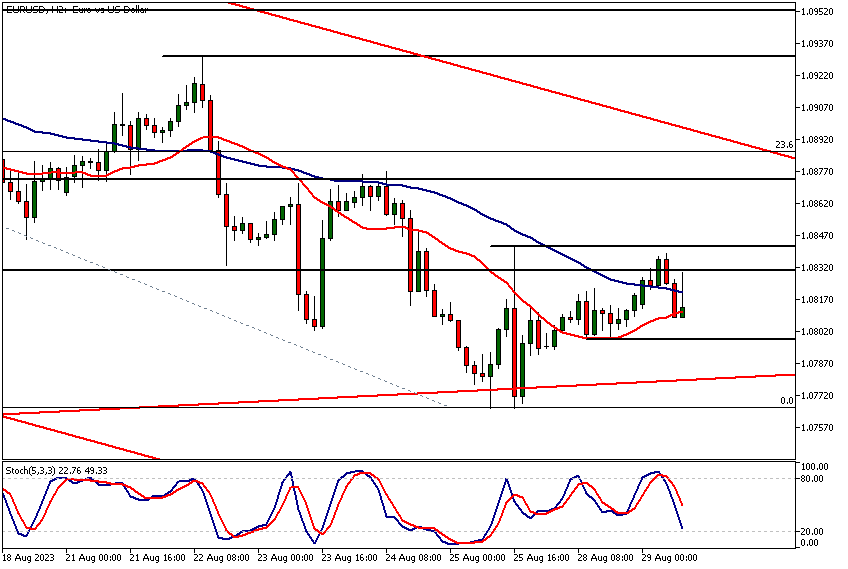

EURUSD technical analysis, 2h chart

In the 2h chart we can see how the market created a double bottom on Friday and has since created a higher low at 1.0800. This low was formed at the 20 period SMA. The market is still trading inside Friday’s range.

If the Friday high at 1.0842 is penetrated with some strength, look for a move to the confluence area above the 1.0875. Should the bulls not be able to penetrate 1.0842, the market has two options: it can either consolidate or continue the daily downtrend.

As per old axiom, what’s in the motion is likely to stay in the motion. In other words, the market momentum is likely to continue until there are clear signs that the trend has been reversed.

Client sentiment analysis

TIOmarkets' clients as a whole have increased their bearish positioning on EURUSD with 79% of the clients holding short positions in the market. This marks a 9% increase from the time of our last EURUSD technical analysis report. It’s good to remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

EUR and USD relative currency strength

As the week has just begun the EUR and USD haven't moved significantly yet. Both of them are under slight pressure while the commodity currencies AUD and NZD have performed the best. CAD and JPY are currently the weakest currencies.

EURUSD fundamental analysis

The German economy is showing significant signs of strain, affecting the EURUSD currency pair. The HBOC Manufacturing PMI indicated a 14th consecutive month of contraction, despite a slight uptick to 39.1.

Consumer hesitancy and destocking trends are exacerbating the situation. In the services sector, which is a major part of the German GDP, the PMI plummeted to 47.3 in August 2023, marking its first contraction in eight months.

High inflation and interest rates are affecting both new business and consumer sentiment. This downturn is further confirmed by the fall in the GfK Consumer Climate Indicator to a dismal -25.5.

Mixed Signals from the US

Federal Reserve Chair Jerome Powell signalled that interest rates could be hiked further to control inflation, yet also hinted that rates might remain unchanged in the next September meeting. Powell emphasized the Fed's cautious monetary policy, targeting 2% inflation.

Simultaneously, the University of Michigan's consumer sentiment index for the US was revised downward for August 2023, with rising inflation expectations. Consumers expressed mixed feelings about the state of the economy, noting that recent improvements seem to be slowing down.

Conclusion

The EURUSD currency pair provided us a case study in counterintuitive behavior on Friday. Despite the persistent economic challenges in the German manufacturing and services sectors (highlighted by contractionary PMI figures) and a general downtrend in the EURUSD pair, the currency reacted positively to Federal Reserve Chair Jerome Powell's speech and the downward revision of the University of Michigan's consumer sentiment index.

Traders appear to be pricing in the possibility of a Fed rate hold in the upcoming meeting and a 50% chance of a 25 basis point rate hike in November. This divergence from a simplistic, hawkish reading of Powell's remarks suggests that market participants might be pricing in most the German economic weakness and the Fed rate hike. Further EURUSD technical analysis and constant monitoring of the market is needed say conclusive if that might be the case.

For more EUR analysis visit our recent EURAUD analysis report.

The next main risk events

- USD - S&P/CS Composite-20 HPI

- USD - CB Consumer Confidence

- USD - JOLTS Job Openings

- AUD - CPI

- EUR - German Prelim CPI

- EUR - Spanish Flash CPI

- USD - ADP Non-Farm Employment Change

- USD - Prelim GDP

- USD - Prelim GDP Price Index

- USD Pending Home Sales

For more information and details see the TIOmarkets economic calendar.

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.