Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Weak jobs and low PPI lift stocks

BY Janne Muta

|July 14, 2023The dollar continued lower and tech stocks rallied due to lower-than-expected US CPI and PPI figures. They followed weaker-than-anticipated job growth. Weaker hiring combined with lower inflation means the Fed is not likely to keep hiking rates after the July meeting. Although there are some signs of the dollar stabilizing against the yen it is still in a downtrend against the major rivals.

Recent data from China, showing a significant 12.4% year-over-year decline in Chinese exports for June, suggests that US inflation is likely to continue its downward trend. This drop represents the largest decline since early 2020. The decrease in Chinese exports can be attributed to the high cost of living, which poses challenges for consumers in Western nations to spend. As a result, the reduced demand for goods and services impacts Chinese exports.

The Reserve Bank of Australia has announced its next governor: Deputy Governor Michele Bullock. Apart from media attention, the news didn’t impact the AUD significantly. Her appointment is seen as a gradual change in policymaking rather than a revolutionary shift.

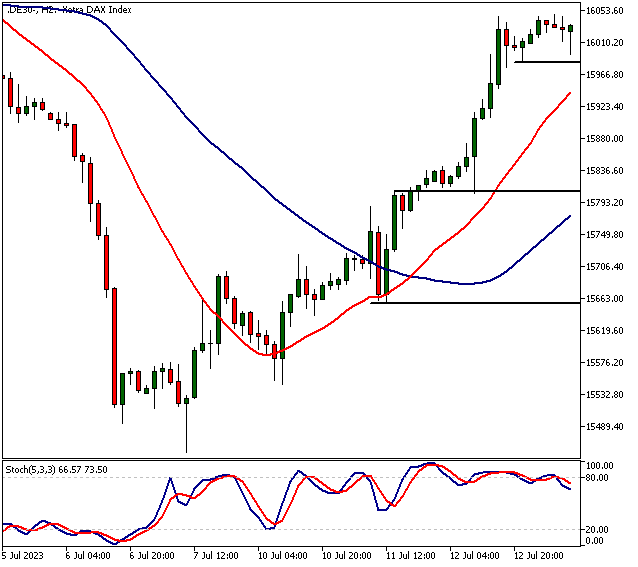

DAX

Dax has been rallying strongly higher. Now the market is trading near a key resistance level (16 210) and has lost some momentum. If the level is penetrated decisively, Dax might trade to 16 400 while a failure to penetrate the level would be likely to result in more weakness. This could take the market down to 16 000.

S&P 500

S&P 500 is bullish above 4488. Below the level, the market could move down to 4460. The nearest major resistance level is at 4636. The market is, however, trading at a bull channel top which could slow the rally down.

Nasdaq

Nasdaq is bullish above 15 500. Below the level, Nasdaq could move to 15 450. Above 15 500 the nearest important resistance level is at 15 850 (the bull channel high). At the time of writing this, the nearest key support level is at 15 540.

EURUSD

EURUSD is bullish above 1.1110 but quite extended (far from this support) at the moment. Therefore the USD short trade could be getting crowded. Below the 1.1110 level, the market could move to 1.1040. If the market remains bullish a move to 1.1280 could be likely.

The next main risk events

- USD - FOMC Member Waller Speaks

- USD - Preliminary UoM Consumer Sentiment

- CNY - GDP

- CNY - Industrial production

- USD - Empire State Manufacturing Index

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.