Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Powell: “More restriction coming”

BY Janne Muta

|June 29, 2023The dollar traded higher and stocks remained mixed after Fed Chair Powell said the monetary policy hasn’t been restrictive that long, and that there is likely “more restriction coming.” Dow closed almost unchanged yesterday (0.2%) while Nasdaq gained 0.4% as Apple moved to new a record ($189.25) and Tesla jumped 2.4%. Figures on Tesla’s Q2 deliveries are expected over the coming weekend.

Dax (0.37%) gained some ground right after Frankfurt opened for trading but then lost momentum and traded sideways for the rest of the day. Gold stayed bearish with the dollar strengthening as the markets are expecting the Fed hike in July. Euro bids have been soft as the markets question ECB’s willingness to hike in September and the expected July hike is already priced in. USDCAD is trending higher in the 2h chart as the Canadian CPI was in line with expectations.

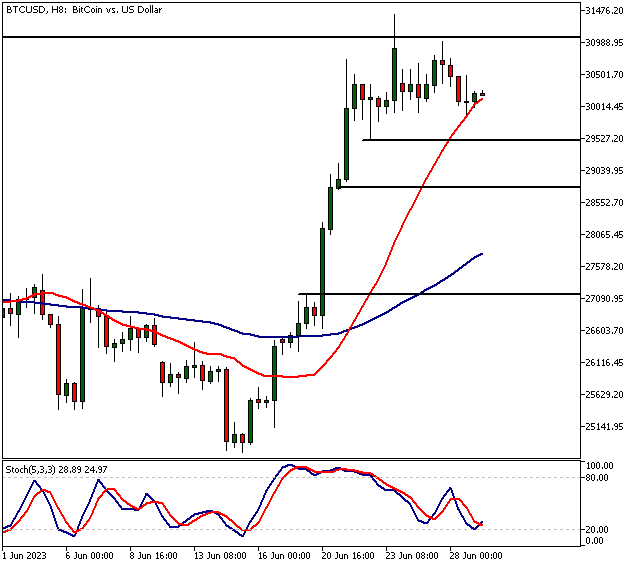

Bitcoin

After rocketing higher last week on the news that BlackRock's application for a Bitcoin ETF could be accepted by the SEC Bitcoin is now trading near a weekly high (31 050) from April. This is a risk factor for the bulls that are timing their buys at current levels. Another risk factor is the fact that the market has created a lower high in the 8h chart.

The key support level to focus on is at 29 516. If the market breaks the level, we could see a move to 29 500 and then possibly to 28 300. Above 31 050, the market could move to 36 300. If BlackRock’s application gets approved some of its AUM (currently around $8.6 trillion) will be allocated to the fund. This would be likely to give the market another boost.

Gold

Gold is bearish below 1918 and could move to 1885. Above 1918, the market is likely to move to 1935. Gold is trending lower as the US bond yields stay elevated and traders place almost 82% probability on a Fed rate hike in July. This has strengthened the dollar.

EURUSD

EURUSD is bearish below 1.0930 and could move to 1.0850 and then possibly to 1.0810 on extension. Above 1.0930, the market could move to 1.0970. The Fed rate hike expectations together with the uncertainty related to the ECB’s willingness to hike in the September meeting are making the EUR bids softer. Based on the recent price action 25 bp hike in the July meeting is already priced in.

USDCAD

USDCAD is bullish above 1.3230 and could trade to 1.3320. Below 1.3230, look for a move to 1.3180. USD bids have remained firm against the CAD after the Canadian CPI was in line with expectations.

The next main risk events

- EUR German Prelim CPI

- USD Fed Chair Powell Speaks

- EUR Spanish Flash CPI

- USD Final GDP

- USD Unemployment Claims

- USD Final GDP Price Index

- USD Pending Home Sales

- JPY Tokyo Core CPI

- CNY Manufacturing PMI

- CNY Non-Manufacturing PMI

- NZD RBNZ Statement of Intent

- EUR CPI Flash Estimate

- EUR Core CPI Flash Estimate

- CAD GDP

- USD Core PCE Price Index

- USD Revised UoM Consumer Sentiment

- CAD BOC Business Outlook Survey

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.