Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Low CPI outlook lifts stocks, weighs on USD

BY Janne Muta

|July 12, 2023Equities rallied and the dollar kept on losing ground in yesterday’s trading. Today’s US CPI could in theory change these dynamics but in practice, the chances of this happening are pretty low. US inflation is widely expected to come in lower than a month ago and the Fed Funds Futures traders are pricing in a 92.4% probability for a 25 bp rate hike and then no hikes for the rest of the year.

The June y/y inflation rate is expected to have decelerated to 3.1%, marking the 12th consecutive month of declines and the lowest reading since March 2021. This slowdown is partly due to the high base effect from the previous year but it is expected that the inflation rate for rent has slowed, and prices for used cars are projected to decrease. The core inflation, (excludes volatile food and energy prices), is expected to decline to 5%, the lowest since November 2021 (5.3% in May).

What could change the future inflation readings though is the price of oil. The energy sector rallied 2.2% yesterday helping the S&P 500 to gain 0.64%. The reason: The rallying price of oil. The oil market is responding to the production cuts by Saudi Arabia and Russia. If China starts to stimulate its economy, the price of oil is likely to keep on appreciating. The higher oil price will eventually show in the inflation numbers and could then impact the Fed and the market expectations on what the Fed is likely to do.

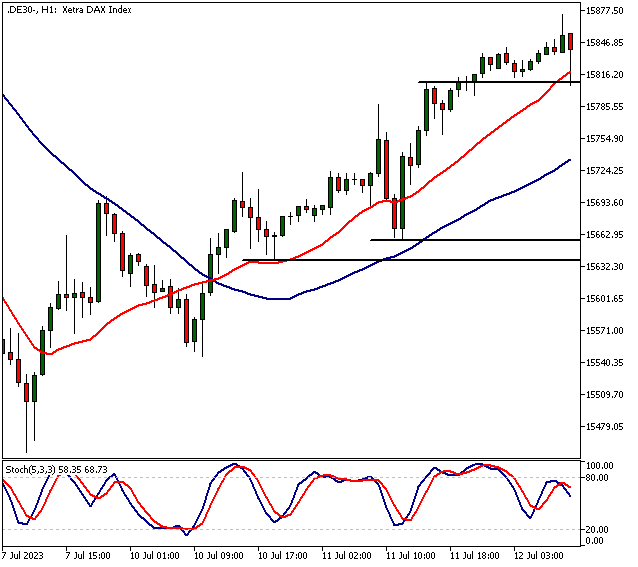

DAX

DAX remains in a short-term uptrend and is bullish above 15 708. Below the level, the market could move down to 15 640. The market is reacting higher after it broke some key supports last week and has created a lower reactionary high (16 209) and a lower low since the June peak (16 428). This is why, there’s a risk that this rally could eventually fail. If there’s another lower reactionary high below 16 209 we might see a deeper retracement in the weekly uptrend. However, as long as the upside momentum lasts there could be opportunities on the long side.

FTSE

FTSE has been relatively weak over the last two days. The market has barely reacted higher even though the other indices we follow indices have rallied nicely. Usually, a market that’s much weaker than the others sells off when/if there’s again weakness in the others. Alternatively, if the others keep on pushing higher relatively weak markets tend to eventually follow the others. FTSE needs to break decisively above 7306 which could open the way to 7370 and then possibly to 7400. Alternatively, the pressure builds against the weekly support level at 7200.

USDJPY

USDJPY remains in a downtrend and is bearish below 141.00. Above the level, the market might move to 141.90. The next major support level below the market price at the time of writing this is at 138.43.

EURUSD

EURUSD has been rallying higher for four consecutive days. The market remains bullish above 1.1000. Below the level, the market might trade down to 1.0960. Above the current market price, the nearest major resistance level is the May high at 1.1090.

The next main risk events

- USD - CPI and Core CPI

- CAD - BOC Overnight Rate

- GBP - UK GDP

- USD - PPI and Core PPI

- USD - Prelim UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.