Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

GBPUSD Technical Analysis | Hawkish BoE stance rallied the market

BY Janne Muta

|December 15, 2023GBPUSD Technical Analysis - Yesterday, the Bank of England (BoE) decided to maintain the Bank Rate at 5.25%, following a 6–3 vote by the Monetary Policy Committee. The number of MPC members voting for a rate increase remained at three surpassing the market expectation of two members. According to the BoE the decision is part of ongoing efforts to control inflation while supporting economic growth.

Key factors influencing this decision included a decrease in Consumer Price Index (CPI) inflation to 6.7% in September, primarily due to lower core goods price inflation, although services inflation remains high.

The BoE anticipates a further decline in CPI inflation, projecting it to fall to 4.5% by Q1 2024. The labour market is showing signs of softening, with slowing employment growth and vacancies, but wage growth remains elevated prompting the bank to maintain the rates at elevated levels.

The central bank sees various risks, including energy prices and their potential impact on domestic prices and wages. The BoE noted that it is committed to achieving a sustainable 2% inflation target in the medium term and is prepared to adjust policies as necessary.

On Wednesday, the US Federal Reserve maintained the federal funds rate at 5.25%-5.5% but projected potential cuts in 2024, including three quarter percentage point reductions. Opinions within the Fed varied on the extent of these cuts though. At the same time, Fed Funds futures traders expect six rate cuts starting from March 2024. The current probability for a rate cut to take place in March is 70.9%.

Summary of This GBPUSD Technical Analysis Report:

- GBPUSD rallied over 2% this week, reaching 1.2787 resistance, fuelled by the divergent policies of the Fed and BoE. The market shows bullish signs, with potential to target 1.2903 and 1.2950 if it breaks above 1.2787. Failure could see a retracement to 1.2620 or 1.2503 support.

- Yesterday's wide-range candle post-BoE decision suggests bullishness in daily trading. GBP/USD is within a bullish trend channel, near 1.2787 resistance. A break above could lead to 1.2903, while a retracement may drop it to 1.2615. The moving average analysis supports continued bullishness.

- Intraday, GBP/USD is trading sideways, hovering above 1.2740 in a narrow range. A break below could test the 50-period SMA at 1.2680, indicating bearishness. However, if the level holds, particularly near 1.2740, an upward trend may resume, potentially surpassing 1.2794.

Read the full GBPUSD technical analysis report below.

GBPUSD technical analysis

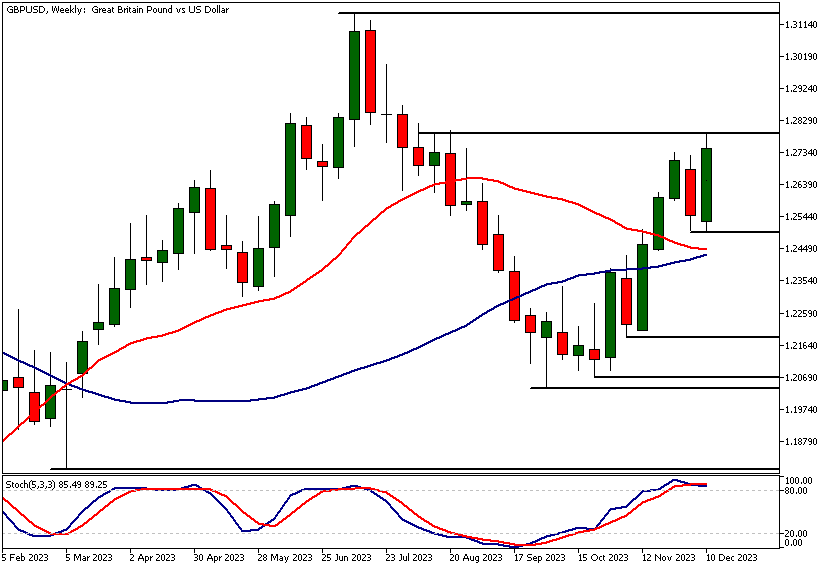

Weekly GBPUSD technical analysis

The GBPUSD currency pair has rallied over 2% this week, following institutional buying that prevented a retracement at 1.2503. The market has now rallied to a resistance level at 1.2787, continuing the upward trend. The expectation that the Fed will cut rates, while the Bank of England has signalled its readiness to maintain higher rates for longer, has provided a boost to the market.

Even though the 20-period moving average is still pointing lower, moving average-based GBPUSD technical analysis suggests the market is bullish, as the 50-period SMA points higher and the market trades above it. If the market can rally decisively above 1.2787, we could see GBPUSD targeting 1.2903 and then possibly 1.2950 on extension.

Alternatively, if the market fails to move above 1.2787, it could retrace back to 1.2620. The nearest weekly support level can be found at 1.2503.

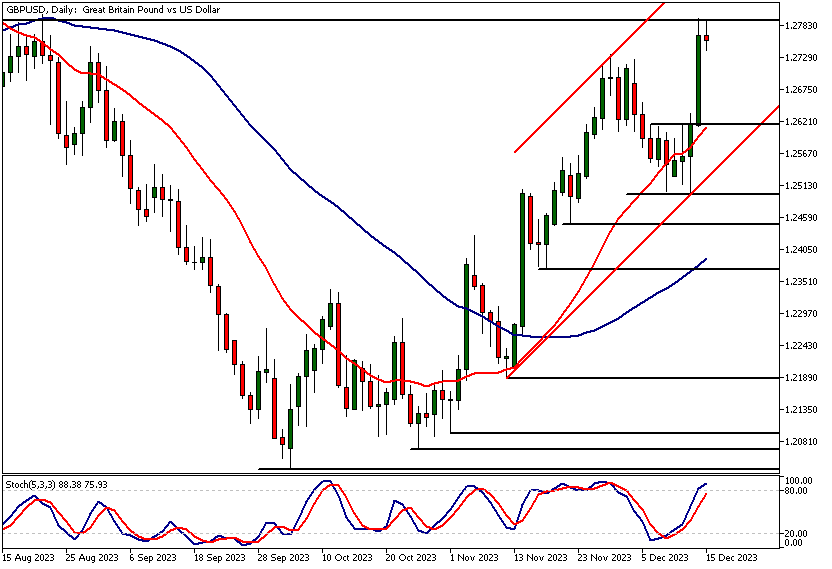

Daily GBPUSD technical analysis

The wide-range candle created yesterday after the BoE rate decision indicates bullishness. The cable trades inside a bullish trend channel, which, as mentioned in the weekly GBPUSD technical analysis section, is right below a key resistance level.

If the market can rally above the 1.2787 resistance level and maintain the upside momentum, traders could target the upper end of the ascending trend channel (currently at 1.2903). Should there be a retracement, we might see the market trading down to a market structure level at 1.2615.

Moving average-based GBPUSD technical analysis indicates that the market bias is likely to remain bullish, as the averages point higher and the SMA(20) is positioned above the SMA(50).

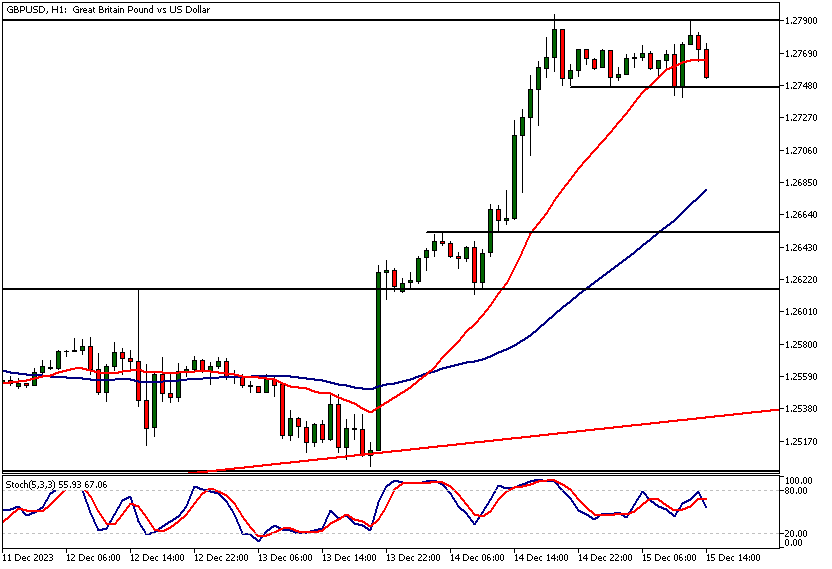

Intraday GBPUSD technical analysis

The market is trading sideways in a narrow range on the 1-hour chart. The low of the range at 1.2748 has been briefly penetrated, but no decisive break of the level has occurred yet. Therefore, the market remains bullish in this timeframe above 1.2740.

However, if there is a decisive break below 1.2740, the market could test the 50-period SMA at 1.2680. GBPUSD technical analysis suggests that the lower reactionary high at 1.2790 increases the risk of the market breaking below the support level. Alternatively, if the GBP bulls are willing to defend levels near 1.2740, we could see the market continuing in the direction of the trend and breaking above 1.2794.

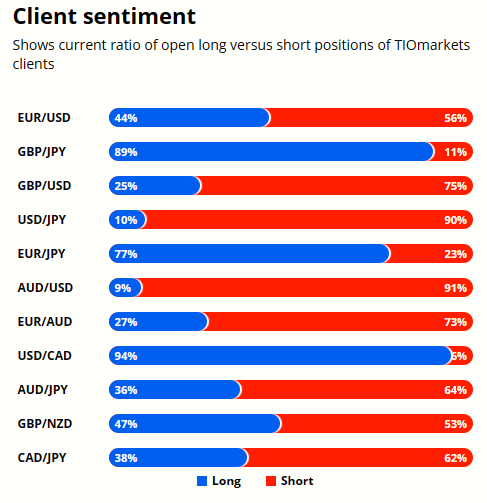

Client sentiment analysis

25% of clients trading GBPUSD are holding long positions, while 75% are holding short positions. Client sentiment data is being provided by TIO Markets Ltd.

It’s good to remember that retail client trading sentiment is a contrarian indicator as most retail traders are on average trading against market price trends. This is why experienced traders tend to trade against the retail client sentiment.You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market

- USD - Flash Manufacturing PMI

- USD - Flash Services PMI

- USD - Building Permits

- GBP - CPI y/y

- USD - CB Consumer Confidence

- USD - Existing Home Sales

- USD - Final GDP q/q

- USD - Unemployment Claims

- USD - Final GDP Price Index q/q

- USD - Philly Fed Manufacturing Index

Potential GBPUSD Market Moves

In the bullish scenario, if the market breaks above 1.2787, it could target 1.2903 and extend to 1.2950, fuelled by divergent central bank policies. Alternatively, in a bearish turn, failure to surpass 1.2787 might lead to a retraction to 1.2620, and if breached, the next support at 1.2503 could be tested.

How Would You Trade GBPUSD Today?

I hope this GBPUSD technical analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

TIO Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.