Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

GBPJPY retraces as UK retail sales disappoint

BY Janne Muta

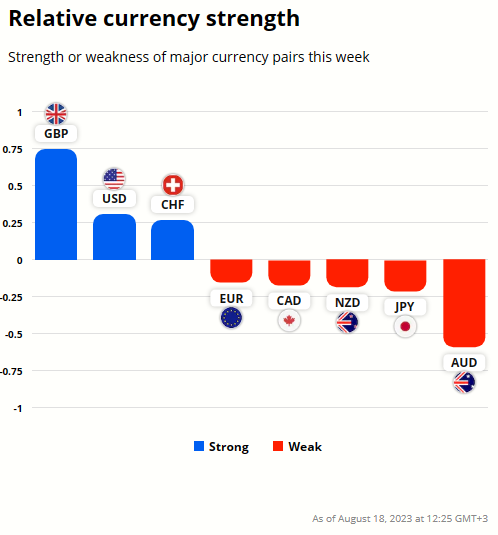

|August 18, 2023UK retail sales disappointed today causing the GBPJPY pair to lose some ground. The uptrend has remained intact though and GBP remains the strongest currency while the JPY is the second weakest right after the AUD. At the same time, most retail traders have positioned themselves bearishly in this market.

Central bank policies in the UK and Japan indicate a probable appreciation of the GBP relative to the JPY. While the Bank of England raised its policy interest rate to 5.25%, seeking to curtail inflation and stabilize the currency, the Bank of Japan remains committed to low or even negative interest rates, aiming to support its export sector and keep the yen competitive. These policies make GBP more attractive to foreign capital seeking higher returns, whereas Japan's low rates deter such capital influx, exerting downward pressure on the yen. Coupled with Japan's economic challenges like high inflation and inconsistent trade balances, GBP's strengthening against JPY seems more likely.

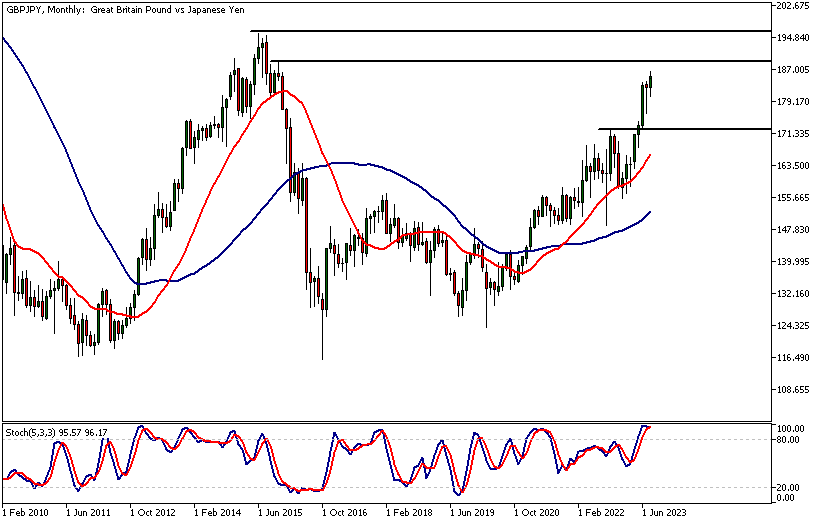

GBPJPY, Monthly Chart

The long-term chart (monthly) shows the next major resistance for the GBPJPY pair is at 188.79. That’s about 1.2% away from the current market price. The market is trending strongly higher. The nearest key support level is at 172.12. Therefore, the immediate upside potential could be getting limited in terms of the longer-term picture. However, intraday charts provide us with a more detailed picture.

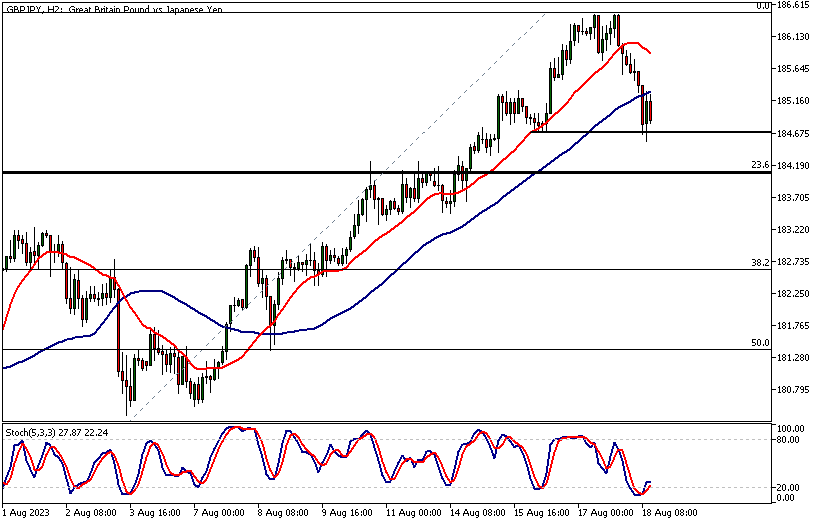

GBPJPY, 8h Chart

The 8h shows the market trading at a confluence level where the 20-period SMA and recent minor support level (184.70) coincide. Today’s UK retail sales disappointment pushed the market to this support. The market bouncing higher from the level in the context of an uptrend suggests that buyers are still interested in the market. Should the 184.70 level give in, look for a move to 184.00 where the 23.6% Fibonacci retracement level and recent support level (a penetrated high) coincide.

GBPJPY, 2h Chart

In the 2h timeframe, the market is oversold as per Stochastics Oscillator (5.3.3). The market is for the first time since August 7th trading below the 50 period SMA which is a risk factor for the bulls. If the market can rally above it and maintain levels above the moving average the trend is likely to continue and the market might test 1.8646 high again.

Client sentiment

TIOmarkets' client positioning remains bearish on GBPJPY. Only 6% of clients currently holding positions in this currency pair are trading with the trend. The others are betting against it. Note that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trend. Therefore, more experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

Currency strength

GBP remains the strongest currency with the JPY being the second weakest right after the AUD. This dynamic will obviously change at some point when the trend in GBPJPY changes but as long as the bullish trend remains intact higher prices are more probable.

Japan Macroeconomic Trends

Japan's economic landscape is a tapestry of strengths and challenges. There was a decline in the unemployment rate to 2.5% in June, marking its lowest point since January. This was a testament to a strengthening labour market, even as the manufacturing sector showed signs of contraction for half of the year. While the Bank of Japan (BoJ) held its interest rates steady, it introduced more flexibility to its yield curve control policy, reflecting an adaptive approach to changing economic conditions. However, the primary objective remains: to achieve an inflation rate above 2%.

Trade Dynamics and Economic Growth

On the trade front, Japan recorded a surplus in its current account in June 2023, driven by a notable shift from a deficit to a gain in the goods account. However, July saw a trade deficit, underscoring the challenges posed by declining global demand for exports. The bright spot in the economic narrative was Q2 2023, which witnessed a 6.0% growth on an annualized basis, surpassing expectations. This growth was supported by net trade contributions, although private consumption receded, hinting at household financial pressures.

Inflationary Pressures

Inflation remains a significant concern though. The annual inflation rate stood firm at 3.3% in July 2023, notably exceeding market predictions. Key sectors such as food and housing are witnessing price escalations, even as fuel and electricity costs have declined.

Central Bank Policy and Currency Outlook

In sum, while Japan's 2023 economic trajectory reveals promising growth, it is interspersed with challenges like manufacturing slowdowns, inconsistent trade balances, and looming inflation. The BOJ's policies and global economic shifts will play pivotal roles in determining the future trends for JPY. As Japan is an export-centric economy, the BOJ tailors its policies to support its export sector. One key strategy is maintaining low or even negative interest rates. By keeping rates at such levels, the BoJ aims to make Japanese goods more affordable abroad, ensuring the yen's value remains competitive. Lower rates deter foreign capital from seeking higher returns, exerting downward pressure on the yen. The July trade deficit underscores the challenges posed by declining global demand for exports and suggests the pressure will remain on the BOJ to continue its ultra-low monetary policy.

UK Macroeconomic Trends

Today’s retail sales numbers for July saw a 1.2% contraction, more severe than the anticipated 0.5%, largely influenced by inclement weather and increasing costs. This decline in both food and non-food sectors signals concerns, though it's noteworthy that non-store retailing sales saw a 2.8% rise, hinting at changing consumer behaviours.

Central Bank's Response to Inflation

Attempting to address high inflation rates, the Bank of England recently raised its policy interest rate by 25 basis points to 5.25%, marking its highest since 2008. The central bank's aggressive stance aims to restore inflation to a target of 2% in the medium term. Projections suggest that inflation could decrease to 5% by year-end and further to the target rate by Q2 2025.

British Economic Growth

The British economy grew by 0.4% YoY in Q2, surpassing forecasts. Positive trends in the services sector and a rebound in manufacturing offset downturns in the mining sector. Household consumption also rose, reflecting an optimistic consumer sentiment, although unemployment surged to 4.2%, its highest since late-2021.

Earnings and Inflation Dynamics

Earnings paint a bright picture, with a significant 8.2% YoY increase in average weekly wages as of June 2023, indicating a strong wage growth momentum. This means, however, that inflation remains a concern, even though it dropped to 6.8% in July from 7.9% the previous month. The drop was primarily due to falling fuel prices.

Outlook for the GBP

Against the backdrop of these dynamics, the GBP's future might see short-term fluctuations, particularly given the retail sales dip. Nevertheless, the central bank's monetary policy, combined with positive economic growth indicators, suggests a promising medium to long-term outlook for the currency.

The Next Main Risk Events

- NDZ Retail Sales

- EUR French Flash Manufacturing PMI

- EUR French Flash Services PMI

- EUR German Flash Manufacturing PMI

- EUR German Flash Services PMI

- EUR Flash Manufacturing PMI

- EUR Flash Services PMI

- GBP Flash Manufacturing PMI

- GBP Flash Services PMI

- CAD Core Retail Sales

- CAD Retail Sales m/m

- USD Flash Manufacturing PMI

- USD Flash Services PMI

- USD New Home Sales

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.