Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Fed halts but hints at two more hikes

BY Janne Muta

|June 15, 2023Stock markets sold off after the Federal Reserve's decision to maintain steady rates after implementing 10 consecutive rate hikes since March 2022. DJ, S&P 500, DAX and FTSE are correcting lower while Nasdaq is the only major index that has held its ground so far. The Fed's updated projections, hint that two more 0.25% rate hikes could be still coming. This would mean a peak fed funds rate of 5.6%. The 2-year Treasury yield increased by 0.10% to 4.68%, nearly 1.0%.

The May Producer Price Index (PPI), a leading indicator for the future CPI, surprised to the downside, with headline PPI at 1.1% year-over-year, below expectations of 1.5% and last month's 2.3%. Core PPI, excluding food and energy, fell to 2.8% year-over-year, below estimates of 2.9% and the previous month's 3.1%.

The Australian May jobs report exceeded expectations, with a significant increase in employment and a decrease in the unemployment rate. The employment change came in at +75.9K, surpassing the expected +15K, and the unemployment rate dropped to 3.6%, lower than the expected 3.7%. Full-time employment saw a positive change of +61.7K, while part-time employment increased by +14.2K.

The participation rate also reached a record high of 66.9%. These strong numbers support the AUD as market participants expect the RBA may have to implement further rate hikes. The next hike might come as early as next month. The hot inflation and labour market are likely to trigger concerns in the RBA board. However, follow the price action in AUD pairs to see if it supports the fundamentals.

The ECB is anticipated to raise interest rates by 25 basis points, lifting the rates to their highest level since the 2008 financial crisis. Given the current high inflation rate of 6.1% and a core rate of 5.3%, (ECB's target: 2%) the move is expected to come with further quantitative tightening. To get more light on the central bank’s future policies follow President Christine Lagarde's press conference.

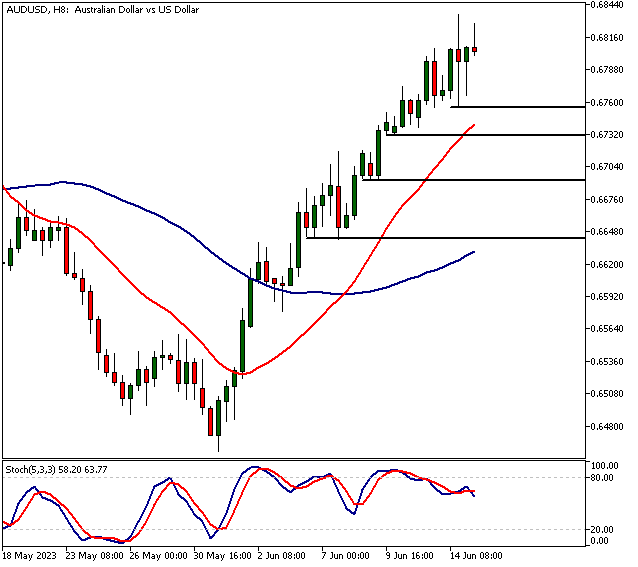

AUDUSD

AUDUSD remains bullish above 0.6755 but note that the market is trading near to a major resistance level which is a risk factor for the bulls. Below the level, the market could trade down to 0.6731 and then possibly to 0.6710. Above 0.6755, look for a move to 0.6835 and then to 0.6920 on extension.

EURUSD

EURUSD is bullish above 1.0774. Below the level, the market probably moves to 1.0760.

USDJPY

USDJPY is bullish above 140.79. Below the level, the market could move to 140.30

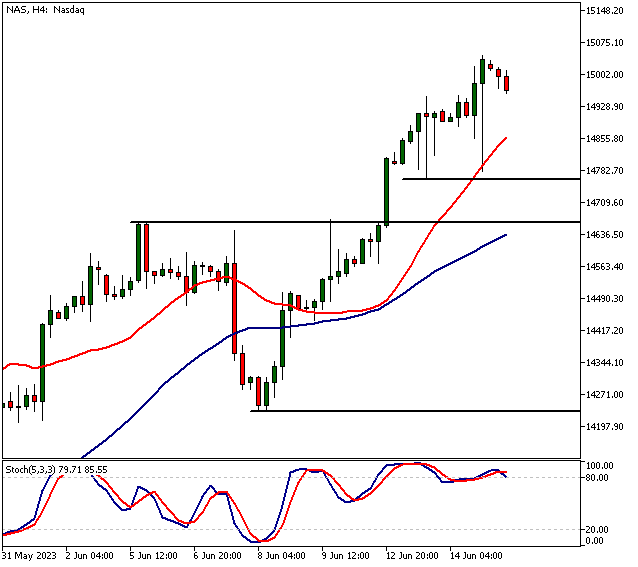

Nasdaq

NAS is bullish above 14 767. Below the level, the market could trade down to 14 663.

The next main risk events

- EUR Main Refinancing Rate

- EUR Monetary Policy Statement

- USD Core Retail Sales m/m

- USD Empire State Manufacturing Index

- USD Retail Sales m/m

- USD Unemployment Claims

- USD Philly Fed Manufacturing Index

- EUR ECB Press Conference

- USD Industrial Production m/m

- JPY Monetary Policy Statement

- JPY BOJ Policy Rate

- JPY BOJ Press Conference

- USD FOMC Member Waller Speaks

- USD Prelim UoM Consumer Sentiment

- USD Prelim UoM Inflation Expectations

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.