Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

DAX Analysis | DAX weakened by recessionary pressures

BY Janne Muta

|August 25, 2023Our DAX analysis today focuses on economic challenges, marked by a contraction in GDP, elevated inflation, and yet a resilient labour market and robust export sector.

Against a backdrop of recessionary pressures and inflationary headwinds, Germany's strong export performance and labour market resilience stand out as buffers.

These factors necessitate a policy discourse focused on sustaining export sector dynamism and implementing counter-cyclical measures.

Fundamental DAX analysis serves as a vital tool for deciphering the intricacies of Germany's current economic landscape, particularly at a time when the nation is confronting multiple challenges such as recessionary trends and high inflation rates.

A second layer of DAX analysis, focusing on technical indicators, further augments our understanding of market sentiment. German economy is slowing down and it shows in the weekly DAX index chart.

The next main risk events impacting DAX are as follows: Fed Chair Powell Speaks, the Jackson Hole Symposium and most importantly the speech by the ECB President Lagarde. Read the full analysis below.

DAX technical analysis

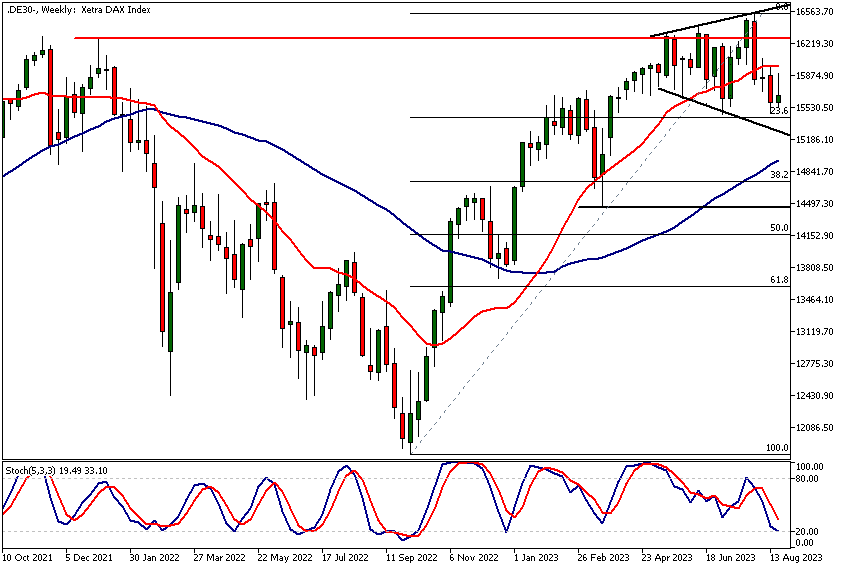

DAX weekly chart analysis

DAX index chart shows a weekly timeframe widening top near to ATH levels. The market wasn't able to push through to new highs and maintain the levels. A widening top formation is a bearish formation that if resolved to the downside could lead to significant market decline.

The market is now trading near the 23.6% retracement level and a recent weekly support level. If there's strong break below 15 454 we might see DAX trading eventually to 14 850. Above the 15 454 level, look for a move to 16 061 and then perhaps to 16 287 on extension.

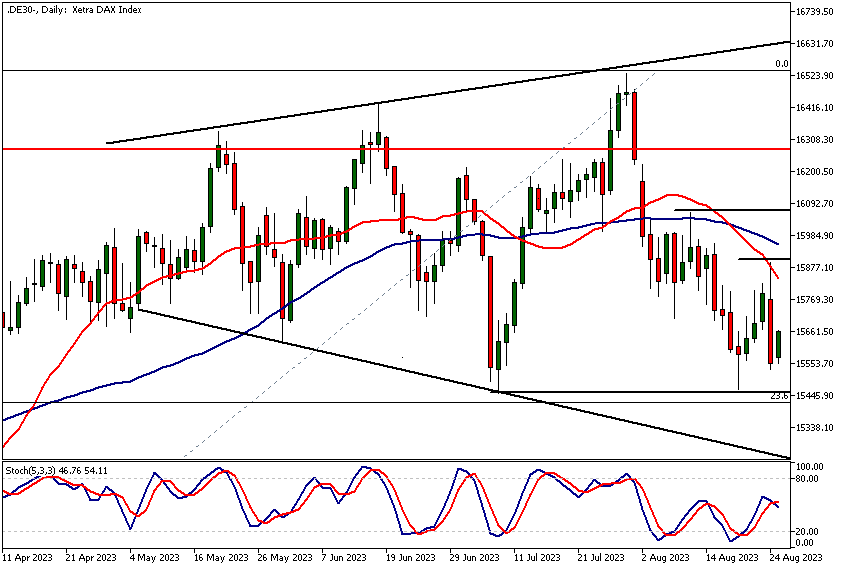

DAX analysis of daily chart

Yesterday's strong downside momentum could lead to further deterioration in the market and to a testing of the 15 455 support. Yesterday's high (15 894) coincides with the SMA 20 which adds to the relevance of the level.

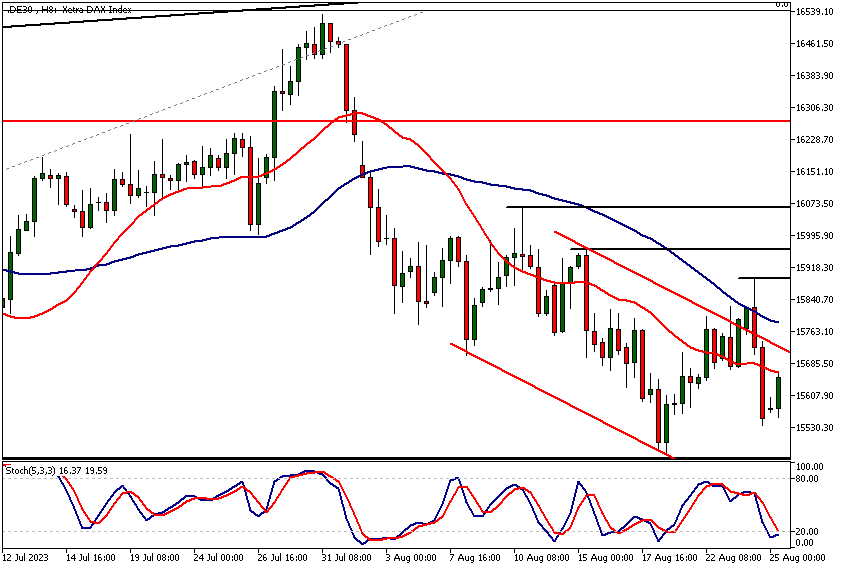

DAX chart, 8h technical analysis

Further DAX anaysis using the 8h chart reveals a failed breakout from the bearish trend channel DAX had been trading for a while. This means the downtrend is more likely to continue in this context. The bearish technical picture would change if the market rallied strongly above the channel top and maintained the levels.

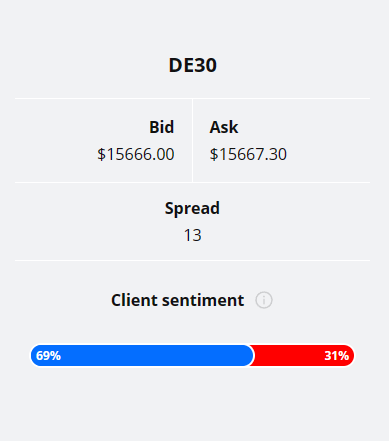

Client sentiment analysis

TIOmarkets' clients are currently mostly long in in DAX index with 69% of the clients holding long positions. It’s good to remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

DAX fundamental analysis

In 2022, exports constituted a significant 45.6% of Germany's Gross Domestic Product (GDP), asserting its role as the cornerstone of the German economy. The robustness of Germany's export sector may have a positive impact on the DAX 40 index even though the market has performed somewhat sluggishly over the recent weeks. This where technical Dax analysis can provide more guidance.

The country's export portfolio is diversely structured, ranging from manufactured goods such as automobiles and machinery to services sectors like tourism and financial services.

The robustness in export performance can be attributed to various factors including a highly skilled labour force, sophisticated infrastructure, and Germany's geographically strategic location within Europe.

Moreover, Germany's membership in the European Union facilitates access to a large, integrated market, thus augmenting its export potential.

Dax index and the German macroeconomic landscape

The German economy is, however, facing headwinds as evidenced by the 0.2% year-on-year contraction in real GDP during Q2 2023. Fundamental Dax analysis the context Germany's trade balance provides, a factor that often moves the DAX index.

Following a similar performance in the previous quarter, the 0.2% contraction marks Germany's entry into a technical recession. This contraction for three consecutive quarters underscores the vulnerabilities facing the German economic apparatus.

The deceleration in GDP growth is notably pervasive. Q2 2023's 0.2% contraction, down from a 0.3% contraction in Q1, manifests a broader trend of economic sluggishness. As Germany navigates through recessionary pressures, we employ technical Dax analysis to track likely movements in the DAX 40 index.

Inflation Trends

In terms of price stability, the inflation rate subsided marginally to 6.2% in July 2023, compared to 6.4% in June. Though this represents the first deceleration in inflation since February 2023, it remains significantly elevated and misaligned with the European Central Bank's (ECB) target inflation rate of 2%.

The moderation in inflation can be partly attributed to an alleviation in energy prices and a decline in core inflation. Nonetheless, the inflationary environment continues to raise concerns about purchasing power and real income, adding another layer of complexity to economic policymaking.

If the ECB remains hawkish the impact on DAX index would quite likely be negative. However, there are other factors influencing our DAX analysis also as no market is driven by a single factor only.

Labor Market Dynamics

On a more sanguine note, the labour market exhibited resilience as the unemployment rate marginally reduced to 5.6% in July 2023, down from 5.7% in June. This rate is the most favourable since 2019 and suggests that the labour market remains relatively insulated from the broader economic slowdown, largely due to the sectoral composition that heavily leans towards exports.

Trade Statistics

Trade data further corroborates the structural robustness of the German economy. Exports escalated to €131.55 billion in June 2023 from €131.09 billion in May, marking the third consecutive month of export growth.

This uptick is primarily a function of robust global demand for German goods. However, imports declined to €112.6 billion in June 2023 from €113.2 billion in May, indicating weaker domestic demand, another reflection of the economic slowdown.

In Summary

The German economy is navigating through a challenging phase marked by recessionary pressures and inflationary headwinds. However, its strong export performance and resilient labour market provide some buffer against these adversities. The policy discourse should ideally be centred around sustaining the export sector's dynamism and implementing counter-cyclical measures to mitigate the ongoing slowdown. The economic trajectory for the remainder of 2023 is likely to be characterized by subdued growth, necessitating vigilant monitoring and agile policymaking. In this context, our intention is to focus on both fundamental and technical Dax analysis to offer a more conclusive view into the performance of German DAX index.

The next main risk events

- USD - Revised UoM Consumer Sentiment

- USD - Fed Chair Powell Speaks

- All markets - Jackson Hole Symposium

- EUR - ECB President Lagarde Speaks

For more information and details see the TIOmarkets economic calendar.

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.