Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Cooling demand to lower inflation

BY Janne Muta

|July 11, 2023Equity investors were cautious but based on index-level price action slightly optimistic yesterday. Investors wait for the US inflation data and the start of the earnings season. Industrials, health care and energy sectors were in favour while communication and utilities sectors lost some ground.

Lower US second-hand car prices, together with lower producer prices in China hint at demand and inflation cooling in the major economies. Analyst consensus expects to see a drop in headline and core CPI tomorrow. At the same time, the Fed is expected to hike rates but the central bank is likely approaching the end of its tightening campaign. Bond yields remained high but started to reverse slightly supporting the price of gold.

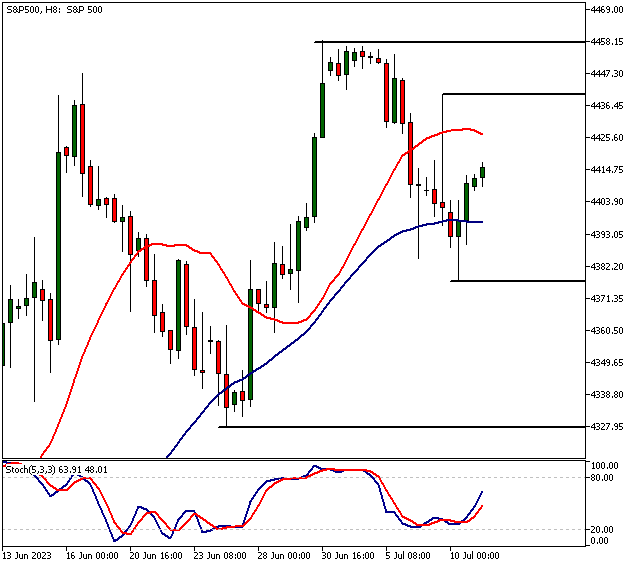

S&P 500

S&P 500 is bullish above yesterday’s low (4377.50) and could trade to 4440. Below the 4377.50 level, look for a move to 4340. The market has been trending higher for several months now and is still relatively far from the December 2021 high. Therefore, the recent slowdown in the bull move could be just another dip the bulls use as a buying opportunity.

DAX

DAX is short-term bullish above 15 640. Below the level, the market could move down to 15 545. The market is reacting higher after it broke some key supports last week. Therefore, there’s a risk that this rally could fail and result in another lower reactionary high below 16 209. If that’s the case, then the German stock market could be in for a deeper retracement.

USDJPY

USDJPY remains bearish below 141.46. Above the level, the market is likely to trade to 142.10. The next major support level below the current market price is at 138.80.

GBPNZD

GBPNZD is bullish above 2.0738. Below the level, a move to 2.0642 would be likely. The RBNZ isn’t expected to hike rates tomorrow as the New Zealand economy has contracted over the last two quarters.

The next main risk events

- EUR - German ZEW Economic Sentiment

- NZD - Cash Rate

- USD - CPI and Core CPI

- CAD - BOC Overnight Rate

- GBP - UK GDP

- USD - PPI and Core PPI

- USD - Prelim UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.