Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

US stocks sold off on BOJ tweak rumours

BY Janne Muta

|July 28, 2023The BOJ made its yield curve control policy more flexible and loosened its defence of the 0.5% yield cap on long-term interest rates. This led to speculation of an eventual shift away from massive monetary stimulus. The BOJ kept ultra-low interest rates for now and emphasized the need for monetary support. The central bank said it would respond "nimbly" to risks like rising inflation. The move resulted in a surge in the yen and yields, along with a decline in stocks.

Yesterday the possibility of a policy tweak by the BOJ led to a sell-off in US stocks and bonds. Dow saw its longest winning streak since 1987 end, and 10-year Treasury yields surged above 4%. The fear is that higher yields in Japan could lead Japanese investors to liquidate their US holdings and repatriate funds. This would cause bond prices to fall and yields to rise. As a result yield sensitive NASDAQ and XAUUSD sold off taking DJ lower with them. Today’s main risk events include German CPI and the US PCE releases. Look for increased volatility after these data releases.

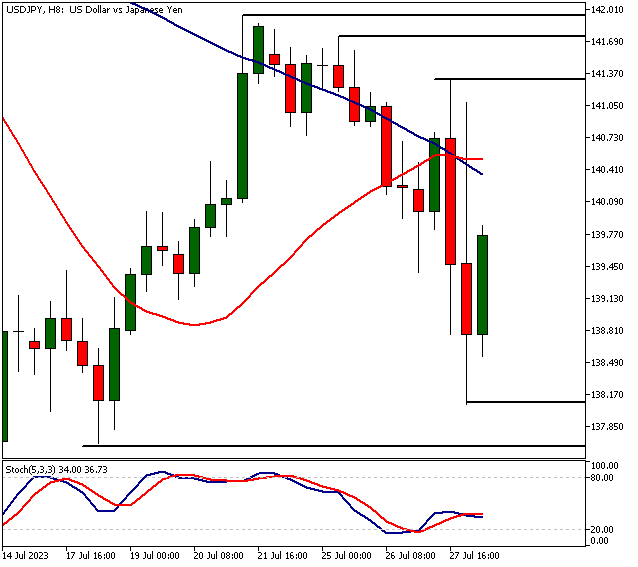

USDJPY

USDJPY whipsawed after the BOJ loosened the defence of the yield cap. The market range for today has been 2.7% with the USDJPY now trading at the lower end of today’s range. If this indeed is the beginning of BOJ shifting away from massive monetary stimulus, then we should see JPY strengthening against the dollar. After the market whipsaw today it’s difficult to analyse the market technically so we’ll give it some time to show us the new direction and what the market participants are collectively thinking about the latest developments.

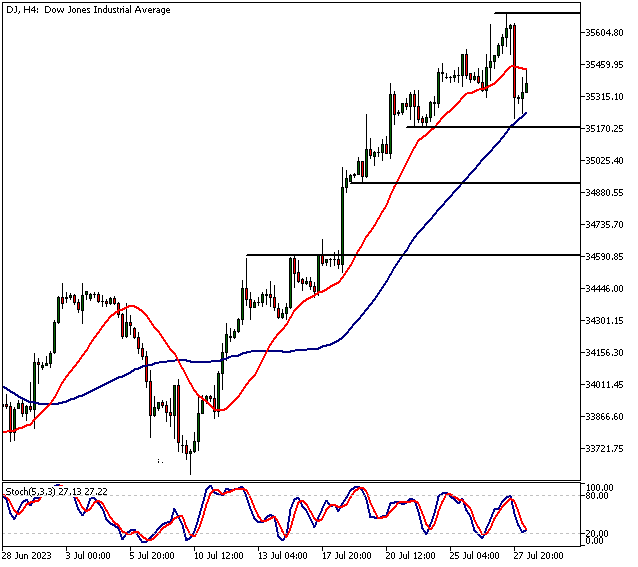

DJ

DJ could be turning bearish. The market closed below previous day's low after the Dow Jones Industrial Average had been trading higher for 13 consecutive days. If DJ creates a lower swing high below yesterday's high (35 686) we migh see DJ trading down to 35 000 first and then possibly to 34 700 on extension. Above 35 686, a move to 35 860 could take place.

S&P 500

S&P 500 sold off yesterday. The market traded down to a key support level at 4527. This level has acted both as a resistance and as a support and is therefore a psychologically significant level. Technically the market remains in an uptrend above 4527 but the weakness seen yesterday in DJ and Nasdaq indicates that the risk of market breaking this level has increased. If 4527 breaks look for a move to 4496 and then possibly to 4458 on extension.

Gold

The failure to rally higher yesterday resulted in gold selling off to a key support level (last week's low 1945.74). A decisive break below this level would turn gold bearish in the short-term. With a lower swing high now at 1982, the risk of market trading below 1945 and heading down to 1928 - 1933 range has increased. If 1945 holds though, look for a move to 1965 and then possibly to 1973.

The next main risk events

- EUR - German Prelim CPI

- JPY - BOJ Press Conference

- CAD - GDP

- USD - Core PCE Price Index

- USD - Employment Cost Index

- USD - Revised UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.