Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Silver Technical Analysis | Silver drops over 6% to a key support area

BY Janne Muta

|December 7, 2023Silver Technical Analysis – In November, US job openings fell by 617K, hitting 8.733 million, the lowest since March 2021 and below the consensus of 9.3 million. However, the services PMI remains positive. November's ISM Services PMI surpassed expectations at 52.7, reflecting a robust services sector with increased activity and employment.

New orders and inventories stayed strong, with slight easing in price pressures. Challenges persist, including inflation, interest rates, and labour costs.

The ADP report missed expectations but still suggests a healthy US services sector. In November, private businesses hired 103K workers, falling short of the expected 130K, with 117K jobs added in the services sector.

Silver's long-term demand will likely stay strong due to diverse applications and its safe-haven status. It's crucial in electronics, solar energy, and medical sectors due to its exceptional conductivity and antimicrobial properties, ensuring steady demand as technology and renewable energy grow.

Summary of This Silver Technical Analysis Report:

- After a strong rally, silver has retraced back to a key market structure area at 23.69 - 23.77. Given the bullish long-term technical outlook, our silver technical analysis suggests that some traders might consider this price range as a potential buying area.

- Currently, the market is trading at the same level where the latest rally began two weeks ago. Traders should closely monitor price action to determine whether silver might attract buyers at this level. If it does, our silver technical analysis suggests that the market could potentially rally to 24.55 and possibly reach 25.30 on extension. Alternatively, there's also the possibility of a move down to around 23.30.

Read the full Silver technical analysis report below.

Silver Technical Analysis

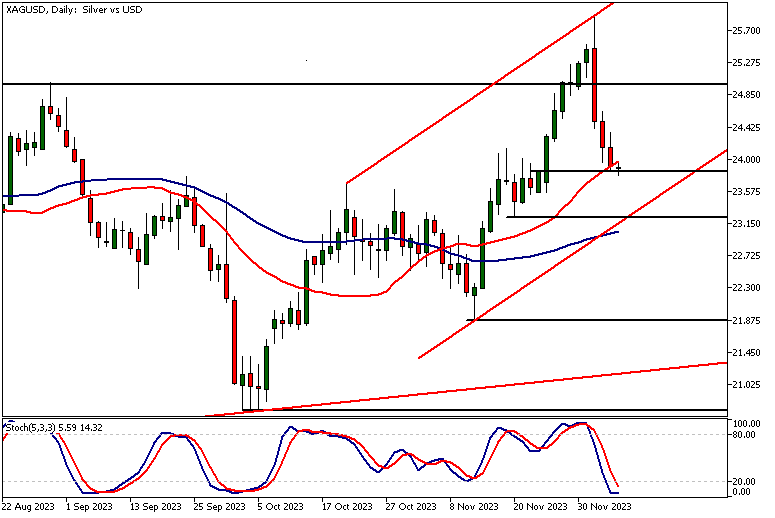

Weekly Silver Technical Analysis

After a strong rally, silver has retraced back to a key market structure area at 23.69 - 23.77. Given the bullish long-term technical outlook, our silver technical analysis suggests that some traders might consider this price range as a potential buying area.

However, if the bears manage to push the market below 23.69, the market could first test the moving averages (currently at 23.34 and 23.43). Below the moving averages, the next weekly support level can be found at 21.87, while the nearest weekly resistance level above the current market price is the April high at 26.13.

Daily Silver Technical Analysis

Silver has rallied by over 18% from its November low but recently suffered a sharp 6.2% decline in just three days. This increased market volatility is primarily driven by the gold market, which experienced a surge to new all-time highs followed by a subsequent collapse. Additionally, the strength of the USD has contributed to the recent decline.

Currently, the market is trading at the same level where the latest rally began two weeks ago. Traders should closely monitor price action to determine whether silver might attract buyers at this level. If it does, our silver technical analysis suggests that the market could potentially rally to 24.55 and possibly reach 25.30 on extension. Alternatively, there's also the possibility of a move down to around 23.30.

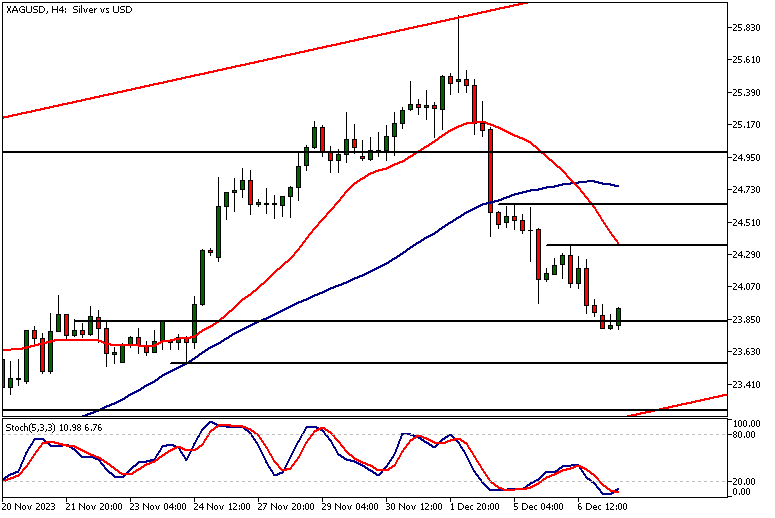

Silver Technical Analysis, 4h

If silver rallies from the current support level, the nearest 4h resistance levels at 24.35 and 24.61 could come into play. The lower level is closely aligned with the SMA(20). The technical confluence at this level could mean that some intraday traders might target this level. However, swing traders could be targeting higher levels (refer to the weekly and daily silver technical analysis section above) as the market is technically still in an uptrend.

The indicator-oriented silver technical analysis suggests that the market is bearish in this timeframe, as moving averages are pointing lower. However, the market is currently trading at a higher timeframe support level, so the 4-hour indications are less likely to be valid.

The next key risk events impacting this market

- USD - Unemployment Claims

- USD - Average Hourly Earnings

- USD - Non-Farm Employment Change

- USD - Unemployment Rate

- USD - Prelim UoM Consumer Sentiment

- USD - Prelim UoM Inflation Expectations

Potential Silver Market Moves

Traders should closely monitor price action to determine whether silver market might attract buyers in the proximity of the 23.69 - 23.77 range.

If it does, our silver technical analysis suggests that the market could potentially rally to 24.55 and possibly reach 25.30 on extension. Alternatively, there's also the possibility of a move down to around 23.30.

How would you trade the Silver today?

I hope this silver technical analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

TIO Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.