Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

S&P 500 Technical Analysis | Rate cut expectations rally the market

BY Janne Muta

|December 14, 2023S&P 500 Technical Analysis - The Federal Reserve held interest rates steady, signalling three possible rate cuts in 2024. This sparked optimism in U.S. markets with the S&P 500 and the other main indices rallying substantially. All eleven S&P 500 sectors rallied with the utilities (+3,78%) and real estate (3.63%) sectors leading the gains while the technology sector only gained 0.88%.

Yesterday, the Federal Reserve maintained the federal funds rate at a 22-year high of 5.25%-5.5% for the third time. While projecting potential cuts in 2024, including three quarter percentage point reductions, opinions within the Fed varied on the extent of these cuts.

Contrary to the Fed's conservative outlook, futures traders expect six rate cuts from May 2024. This decision aligns with a slowing economy, strong job market, declining but high inflation, and projected GDP growth of 2.6% for 2023, decreasing slightly in 2024. The unemployment rate is expected to be 3.8% in 2023, increasing marginally the following year, with a year-end federal funds rate projection of 4.6% for 2024.

Summary of this S&P 500 technical analysis report:

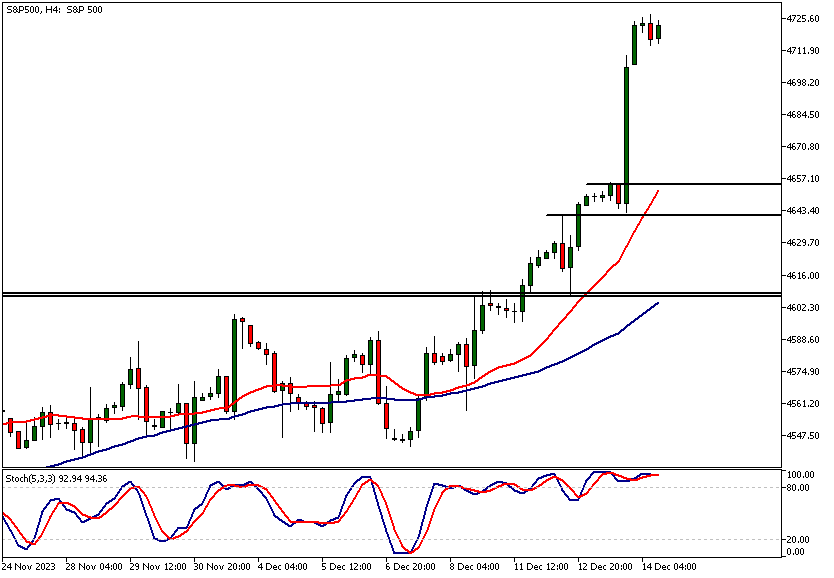

- The S&P 500 surged over 15% from October lows, hitting new 52-week highs. The market is near its all-time high from January 2022, with strong bullish signals from both moving averages and technical indicators, despite the stochastic oscillator indicating overbought conditions. Key weekly support levels lie at 4,607 and 4,638.

- On the daily chart, the market shows robust upside momentum, rallying nearly 4%. A significant retracement seems unlikely. The closest daily support is at 4,600, aligning with weekly support. Moving average analysis reinforces a bullish market outlook, reflecting continued strength in market trends.

- Intraday analysis reveals a significant rally post-Fed rate decision. The market has extended notably, with the nearest 4-hour support at 4,655, backed by the 20-period moving average. The next support is at 4,641. Indicators and moving averages suggest a strong market, with potential targets at the January 2022 high of 4,783 or a retracement to around 4,600.

Read the full S&P 500 technical analysis report below.

S&P 500 technical analysis

Weekly S&P 500 technical analysis

After rallying over 15% from its October low, the S&P 500 has now reached new 52-week highs. The upside momentum has been exceptionally strong, as the index CFD has not experienced any down weeks during the rally. Currently, the market is trading just 2% away from the all-time high set in January 2022.

Although the stochastic oscillator is firmly in the overbought territory, indicator-based S&P 500 technical analysis supports the bullish view suggested by the price action analysis. Both moving averages are pointing higher, with the 20-period SMA above the 50-period SMA. The nearest key weekly support levels are at 4,607 and 4,638, while the nearest major resistance level is the January 2022 high at 4,783.

Daily S&P 500 technical analysis

The upside momentum on the daily chart is very strong, with the market rallying almost 4% in the latest uptrend leg. Even though a deep retracement in the S&P 500 seems unlikely given such strong upside momentum, the nearest daily timeframe support level can be found at 4,600. The market bias remains bullish.

This level is closely aligned with the weekly support level of $4,607 mentioned above. Moving average-based S&P 500 technical analysis also provides a bullish market view.

Intraday S&P 500 technical analysis

The 4-hour chart showcases the substantial rally following the Fed rate decision and the press conference yesterday. The market has moved strongly and is currently quite extended.

The nearest support levels on the 4-hour chart are relatively far from the current market price. The 4,655 support level is the nearest and is closely aligned with the 20-period moving average, which adds to the technical significance of this level. The next support level below this is at 4,641.

Again, indicator-based S&P 500 technical analysis indicates a very strong market. The moving averages are trending higher in line with the price, and they are in a bullish order with the 20-period SMA above the 50-period SMA.

As the upside momentum is so strong, traders could be targeting the January 2022 high at 4,783. Alternatively, we could see a retracement back to around 4,600.

The next key risk events impacting this market:

- USD - Unemployment Claims

- USD - Empire State Manufacturing Index

- USD - Industrial Production

- USD - Flash Manufacturing PMI

- USD - Flash Services PMI

Potential S&P 500 Market Moves

As the upside momentum is so strong, traders could be targeting the January 2022 high at 4,783. Alternatively, we could see a retracement back to around 4,600.

How would you trade the S&P 500 today?

I hope this S&P 500 technical analysis report helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

TIO Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.