Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Risky assets hit after US debt downgrade

BY Janne Muta

|August 3, 2023US equities and bonds faced a significant sell-off following the Fitch downgrading the US debt. This led to Treasury yields rising to this year’s highs and nudged the major equity indices sell-off. The higher yields could pose a challenge to the stock markets in the short term.

In the technology sector, Apple and Amazon.com are set to announce their earnings today, providing investors with valuable insight into how these industry titans performed in the current earnings season and what the markets think of their current valuations.

The downturn was further amplified by the ADP payroll report that revealed a more rapid-than-anticipated job growth for the month. This data suggests that the market's reaction might be largely attributed to concerns about whether additional rate hikes from the Fed are needed in the near future.

In Asia, today's primary data focus was on China's Caixin/S&P Global Services PMI for July. Despite some earlier disappointments this week with the country's PMIs, the Caixin Services PMI surpassed expectations, rising to 54.1 (53.9 previous). This marks the seventh consecutive month that the index has remained above the crucial 50-point threshold, indicating continued expansion in the services sector.

The Bank of England is expected to hike rates for the 14th consecutive time. The consensus amongst investors anticipates 25 basis points (bps) increase to 5.25%, although there is substantial speculation regarding a potential 50bps hike. Regardless of the magnitude of the rate adjustment, the resultant borrowing costs would hit levels unseen since 2008, as the central bank tries to curb high levels of inflation.

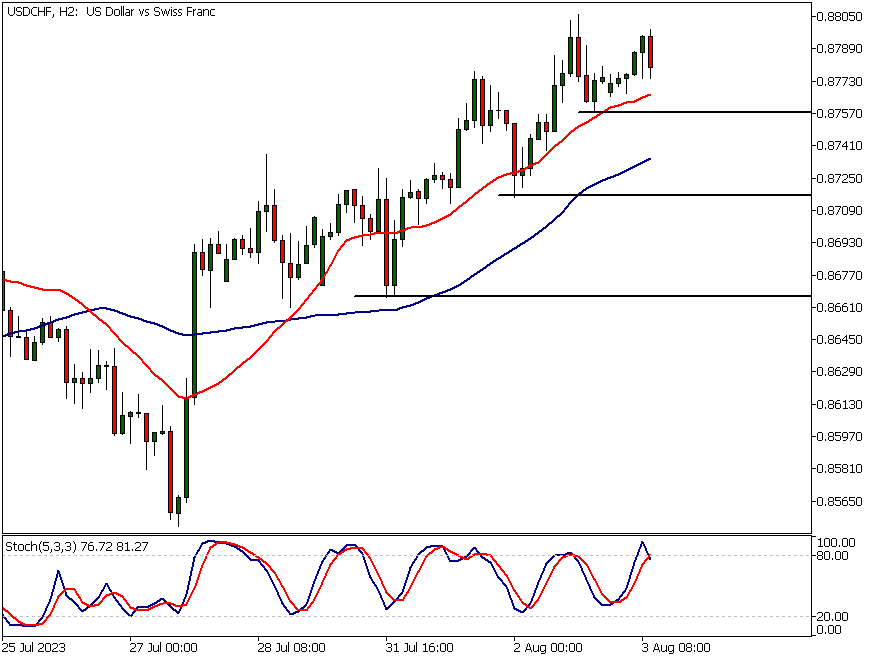

USDCHF

USDCHF trends higher and is bullish above 0.8717. Below the level, the market might move to 0.8665. The nearest key resistance level is at 0.8904.

USDCAD

USDCAD is bullish above 1.3346. Below the level, the market might trade down to 1.3334. The nearest key resistance level is at 1.3387.

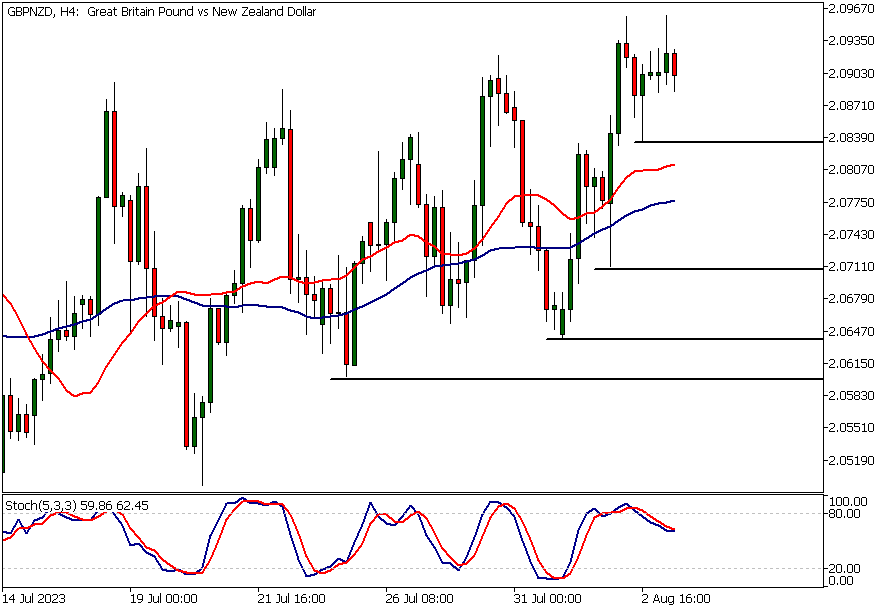

GBPNZD

GBPNZD is bullish above 2.0722. Below the level, the market could move to 2.0643. The GBPNZD currency pair is currently trading near to the recent highs which could cause it to correct lower. The nearest key support level is at 2.0835.

Silver

XAGUSD is bearish below 23.83. Above the level, we might see a move to 24.08. The nearest key support level is at 23.38.

The next main risk events

- GBP - BOE Monetary Policy Report

- GBP - MPC Official Bank Rate Votes

- GBP - Monetary Policy Summary

- GBP - Official Bank Rate

- GBP - BOE Gov Bailey Speaks

- USD - Unemployment Claims

- USD - ISM Services PMI

- AUD - RBA Monetary Policy Statement

- CAD - Employment Change

- CAD - Unemployment Rate

- USD - Average Hourly Earnings m/m

- USD - Non-Farm Employment Change

- USD - Unemployment Rate

- CAD - Ivey PMI

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.