Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Risk off as China fears grow

BY Janne Muta

|August 16, 2023Investor sentiment degrades as worries related to the Chinese economy grow and the strong US retail sales data raises concerns about Fed policy tightening. The main equity indices traded lower after an unexpected surge in retail sales, which climbed by 0.7% in July, outstripping economists' forecasts. This uptick in sales underscores the robustness of US consumer spending. Nonetheless, it hasn't swayed the prevailing sentiment that the Federal Reserve's intense period of monetary tightening has drawn to a close. Today’s main risk event: Fed meeting minutes.

In contrast, China's economic landscape is riddled with challenges. A drop in new home prices in June and a consistent stream of lacklustre economic figures weaken investor sentiment globally. Recent data showed that both industrial production and retail sales fell short of market expectations, coming in at 3.7% and 2.5% respectively against anticipated numbers of 4.3% and 4.2%.

In a bid to counter this, the People's Bank of China (PBOC) trimmed its benchmark one-year medium-term lending rate by 15 basis points to 2.50% and bolstered lending volumes. However, the markets remain unimpressed.

UK's consumer price inflation decreased to 6.8% in July 2023, down from 7.9% in June. This rate, the lowest since February 2022, aligned with market expectations, largely influenced by falling fuel prices. The core inflation rate, excluding fluctuating items like energy and food, stood at 6.9% — consistent with June's figure. However, as it surpasses the Bank of England's 2.0% target, it offers the central bank leeway to persist with its current policy-tightening trajectory.

The European Central Bank might put the brakes on its rate hikes in September. This speculation is set against a backdrop of lingering high inflation rates and unsettling data from Germany, suggesting more headwinds for Europe's leading economy.

DJIA

DJ has been losing ground since moving to new highs for this year four weeks ago. The market has been making lower highs and yesterday’s down move took it below a key support level (35 000). This could open the way for further weakness and possibly take the market down to the 34 280 support level. Above 35 000 we might see a move to 35 360.

S&P 500

S&P 500 is trending lower in the 8h timeframe and remains bearish below 4 500. Above the level, the market could move to 4 525. The next key support level is at 4 377. Relatively speaking Nasdaq has been the weakest of the main indices (DJ, NAS, S&P 500 and DAX) and has dragged the S&P 500 lower. The index has a heavy weighting in technology stocks (26%).

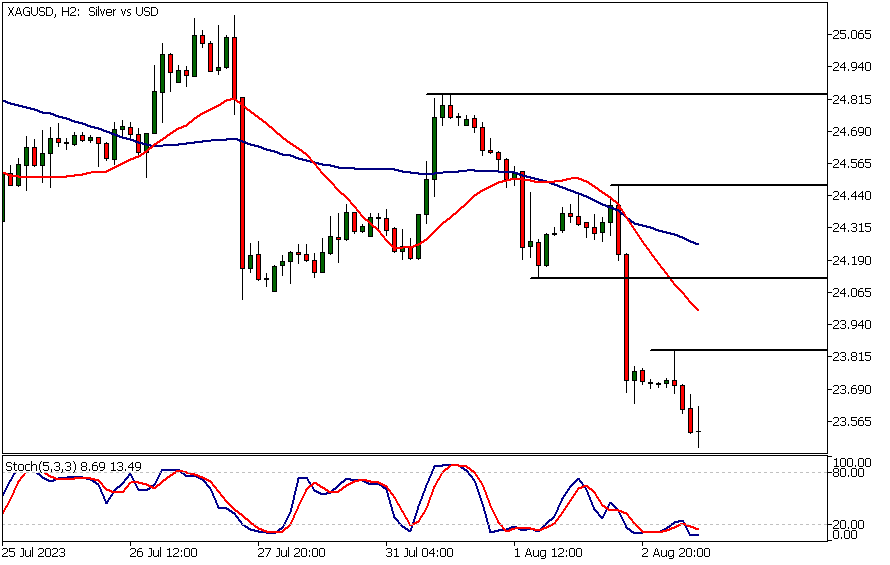

Gold

Gold is in a downtrend but the market is now trading in the proximity of an important (weekly) support level at 1893. If the support holds, look for a move to 1920 and then possibly to 1935. In the case of the 1893 level not holding we might see gold trading down to 1865.

USDJPY

USDJPY trends higher and the trend stays in force above yesterday’s low (145.10). Below the level, the market might trade down to 144.60 while above it the market could move to 148. Over the last three weeks, JPY has been one of the weakest markets among the major USD counterparts. Only AUD and NZD have been weaker. This increases the risk of mean reversion in the USDJPY pair.

The next main risk events

- USD - Building Permits

- USD - Industrial Production

- USD - FOMC Meeting Minutes

- NZD - RBNZ Gov Orr Speaks

- AUD - Employment Change

- AUD - Unemployment Rate

- NZD - RBNZ Statement of Intent

- USD - Unemployment Claims

- USD - Philly Fed Manufacturing Index

- GBP - Retail Sales

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.