Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Rising German core CPI fuels worries

BY Janne Muta

|June 30, 2023The June inflation for Germany rose to 6.4% on a year-on-year basis. This slightly exceeded market predictions of 6.3%. The core inflation rate, which excludes volatile items such as food and energy, increased from 5.4% in May to 5.8%. German inflation exceeding expectations causes worries about today’s eurozone inflation report. Economists anticipate a decline in EU June inflation from 6.1% in May to 5.6% but with the German inflation rising the likelihood of EU inflation exceeding the projections has increased. Be ready to trade the EU wide CPI and the US PCE releases today.

US equity markets closed higher as major banks passed a Federal Reserve stress test, boosting bank stocks. Also, the final revision of Q1 GDP showed 2% growth, surpassing estimates. The increase was driven by strong consumer spending and exports. This pushed treasury yields higher as investors anticipate higher interest rates to tackle inflation. Fed Chair Powell expects more restrictive measures and additional rate hikes. Despite this, the labour market remains resilient, with weekly jobless claims (239K, 264K expected, 265K prior) at their lowest since May.

The official PMI in China increased to 49, matching market expectations. However, this still indicates a contraction in factory activity for the third consecutive month. The latest PMI reading reflects a slowdown in China's post-pandemic recovery, suggesting that the momentum has weakened.

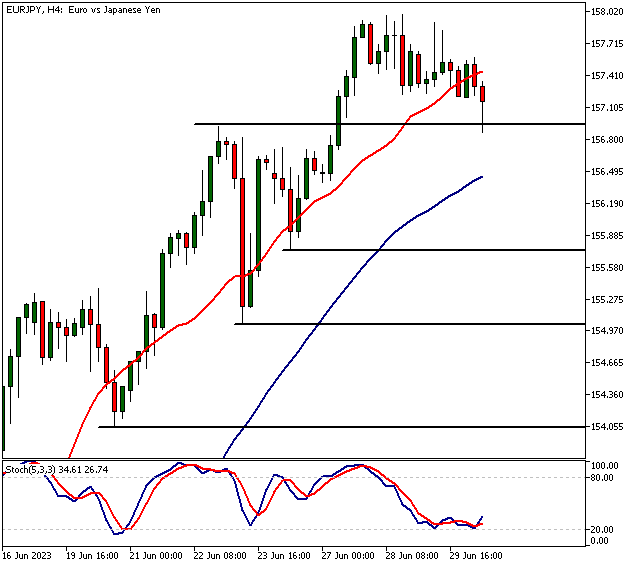

EURJPY

EURJPY is bullish above 156.92. Below the level, look for a move to 155.60.

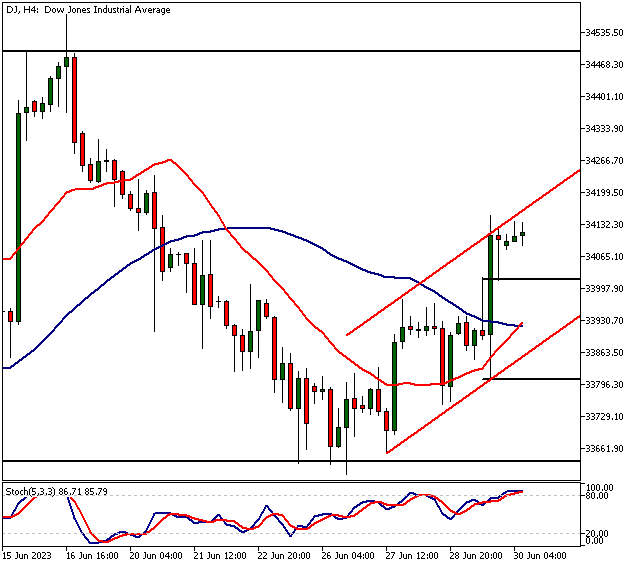

DJ

DJ is bullish above 34 013. Below the level, the market could move to 33 824. The market has lost momentum after yesterday’s rally took it to the bull channel so a pullback towards 34 013 wouldn’t be a surprise. The technical picture indicates though that the investors are likely to use a potential retracement to buy the dip.

S&P 500

S&P 500 is bullish above 4390. Below the level, the market might trade down to 4360. The market is trending higher in the intraday timeframes after the bulls started buying the market at 4328.

Gold

Gold is bearish below 1917. Above the level, a move to 1928 would look likely. Below 1917, look for a retest of yesterday’s low at 1893. Below this level, the market could move to 1885.

The next main risk events

- EUR CPI Flash Estimate

- EUR Core CPI Flash Estimate

- CAD GDP

- USD Core PCE Price Index

- USD Revised UoM Consumer Sentiment

- CAD BOC Business Outlook Survey

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.