Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Oil Technical Analysis | Middle East tensions rally the market

BY Janne Muta

|January 4, 2024Oil Technical Analysis - USOIL experienced a sharp increase of over six percent from yesterday, fuelled by escalating tensions in the Middle East and the looming threat of a regional conflict potentially driving up oil prices and stoking inflation.

In Libya, significant oil fields, Sharara and El-Feel, faced production halts due to local protests. Specifically, Sharara, capable of producing 300,000 barrels daily and one of Libya’s key oilfields, was shut down. This field has been a recurring target in various protests.

Despite the American Petroleum Institute (API) reporting a rise in product stocks, attention is focused on the substantial 7.4-million-barrel decrease in crude inventory, attributed to the situation in Libya and a renewed risk premium.

Adding to the tensions, Houthi militants attacked a merchant vessel in the Red Sea. In Iran, two explosions during a ceremony honouring commander Qassem Soleimani, killed by a U.S. drone strike in 2020, resulted in nearly 100 fatalities and numerous injuries. Iran, pointing fingers at the U.S. and Israel, both of whom deny involvement, has promised retaliation.

These incidents have escalated regional unrest and are influencing global oil markets. The Organization of the Petroleum Exporting Countries (OPEC) and allies like Russia, under the OPEC+ framework, are preparing for an important meeting to discuss potential oil output cuts. This decision is partly a response to Angola's recent decision to exit the group.

Summary of This Oil Technical Analysis Report:

- Over the past four weeks, the oil market has been consolidating above 67.94, with the stochastic oscillator indicating a potential market reversal. A rally above 76.18 could lead to reaching 80.62, a key market structure level and significant resistance point. If the market sustains above 80.62, a further rise to around 88 is possible.

- Yesterday's market activity showed a strong rally, pushing the market above the descending trend channel high and establishing a new reactionary low at 69.40. This suggests a potential new market bottom. A move above 69.40 could target the 75.60-76.18 range, a key technical confluence area.

- The intraday chart shows the oil rally slowing at 73.68. A move below 72.90 could lead to 71.40, aligning with the descending trend channel high. Conversely, breaking above 73.68 might initiate a rally to 75.80. The 20-period moving average crossing above the slower 50-period moving average is yet another early bullish sign suggesting the market is potentially reversing the downward trend.

Read the full oil technical analysis report below.

Oil Technical Analysis

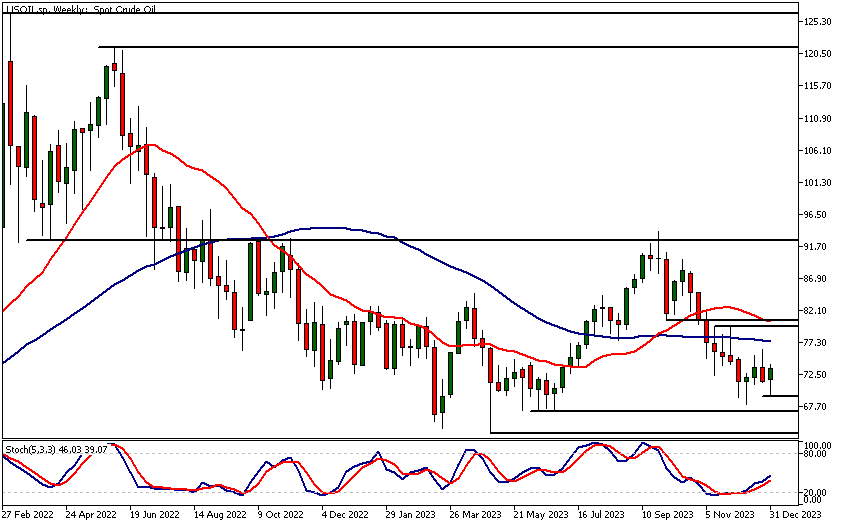

Weekly Oil Technical Analysis

Over the last four weeks, the oil market has been consolidating above 67.94. This is evident in the stochastic oscillator as it moves higher, indicating a potential market reversal. For this reversal to occur, the market must rally decisively above 76.18. Doing so would pave the way to levels near the next key market structure level at 80.62.

This level is closely aligned with the 20-period moving average, suggesting that it could be a significant resistance level. Indeed, this level is the lower end of a triangle formation that the market created in September and October.

Our oil technical analysis suggests that if the market can rally above 80.62 and then maintain levels beyond this price point, it could rally further, possibly reaching around 88. Alternatively, if it falls below 67.94, the market could drift down to 67.40.

Daily Oil Technical Analysis

Yesterday's strong rally once again pushed the market above the descending trend channel high. In the process, the market created a higher reactionary low at 69.40. This suggests that the oil market is in the process of establishing a new potential market bottom. Above yesterday's low at 69.40, we anticipate a move to 75.80.

The 50-period moving average and a swing high at 76.18 create a technical confluence area between 75.60 and 76.18. This area could be targeted by short-term traders.

Oil technical analysis indicates that if the market can rally decisively above 76.18, we might see a move to 79.40. Alternatively, if the momentum fails, a retest of yesterday's low at 69.40 could occur.

Intraday Oil Technical Analysis

The oil rally has slowed down at a minor market structure level at 73.68. If the market moves decisively below 72.90, a decline to 71.40 could be likely. It's important to note that this level roughly coincides with the high of the descending trend channel.

On the other hand, a decisive move above 73.68 could propel the market to rally towards 75.80. Indicator-based oil technical analysis suggests that the market is turning more bullish after a bearish phase, as the 20-period moving average has crossed above the 50-period moving average, and the latter has started to point higher.

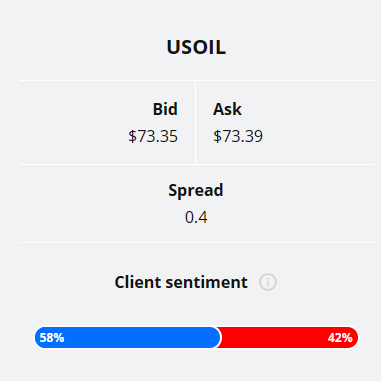

Client sentiment analysis

58% of clients trading USOIL are holding long positions, while 42% are holding short positions. Client sentiment data is being provided by TIO Markets Ltd.

It’s good to remember that retail client trading sentiment is a contrarian indicator as most retail traders are on average trading against market price trends. This is why experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market

- Crude Oil Inventories

- Average Hourly Earnings m/m

- Non-Farm Employment Change

- ISM Services PMI

- FOMC Member Barkin Speaks

Potential Oil Market Moves

On the bullish side, surpassing key resistance levels like 76.18 and 80.62 could lead to significant rallies towards 79.40 and 88, respectively. Bearishly, failing to maintain these levels might result in a downturn, with a potential decline to 67.40.

How Would You Trade Oil Today?

I hope this Oil technical analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

TIO Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.