Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Nasdaq shows relative strength

BY Janne Muta

|June 21, 2023Nasdaq has been a strong performer lately and continues to show relative strength as indices retrace after a strong performance over the last weeks. Equity markets have been trading lower since Friday with DJ pulling back 1.48% from the highs while Nasdaq has declined 1.4%. This softness in the markets has been attributed to a lack of significant data releases or headline news.

However, the tech-heavy Nasdaq index is trending higher as companies like NVIDIA, Meta, Intel and Netflix are catching investors' attention. In this report, we’ll cover INTC, META and NFLX. Interest rates saw a small decrease yesterday, with 10-year Treasury yields falling 3.725 before recovering slightly.

Cable rallied to 1.2802, as the UK CPI came in slightly higher than expected. Market participants have been bidding the market higher ahead of the Bank of England's monetary policy meeting tomorrow. The pound has strengthened as wages have increased the economy has continued to expand.

May inflation data showed the CPI at 8.7% (prior 8.7%) and Core CPI at 7.1% (prior 6.8%). While April's headline inflation rate was the lowest in over a year, it still remains well above the Bank of England's target of 2%. Consequently, investors are speculating that the UK policy interest rate could peak at 5.75% by early next year.

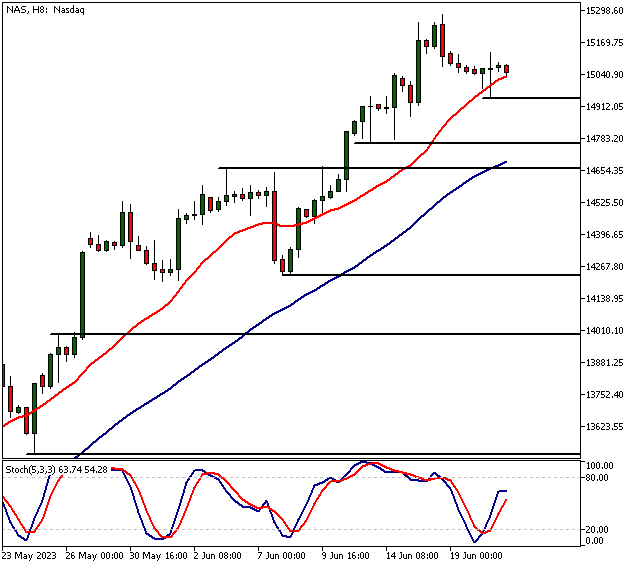

Nasdaq

Nasdaq is bullish above yesterday’s low (14 945). Look for trend continuation above the level. Below 14 945 the market could trade down to 14 890.

Intel

INTC is bullish above 29.75. Below the level, the market could trade down to 27.10. Intel is making significant advances in the AI business with a focus on creating powerful AI computing chips. The company plans to introduce a chip named "Falcon Shores" in 2025 to support the growing demands of large AI models, with features like 288 GB of memory and 8-bit floating-point computation.

Intel has also changed its strategy, moving away from combining GPUs with CPUs, allowing for more flexibility in design and vendor selection. On Monday the company announced that it has struck a deal with the EU to get $10 billion of subsidies to build a chip plant in Germany.

Meta Platforms

META is trending higher as investors see it among the major players in the future AI industry. The stock remains bullish above 258.90. Below the level, look for a move to 244.90. Artificial intelligence is at the core of Meta's products.

With AI being increasingly used in businesses for data analysis, customer service, and process automation, Meta's significant investment in AI positions it to capitalize on these opportunities, indicating a promising future in AI-related business.

Netflix

NFLX is trending higher after the company changed its rules about password sharing. The stock is bullish above 418. Below the level, it could move to 398. Subscription numbers have been rising attracting institutional investors to the stock.

The company has implemented a policy to discontinue the practice of free password sharing, which was being utilized by approximately 100 million of Netflix's customers. This change holds significant potential for increased revenues.

The next main risk events

- CAD - Core Retail Sales

- CAD - Retail Sales

- USD - Fed Chair Powell Testifies

- CHF - SNB Monetary Policy Assessment

- CHF - SNB Policy Rate

- USD - FOMC Member Waller Speaks

- CHF - SNB Press Conference

- GBP - MPC Official Bank Rate Votes

- GBP - Monetary Policy Summary

- GBP - Official Bank Rate

- USD - Unemployment Claims

- USD - Fed Chair Powell Testifies

- USD - Existing Home Sales

- GBP - Retail Sales

- EUR - French Flash Manufacturing PMI

- EUR - French Flash Services PMI

- EUR - German Flash Manufacturing PMI

- EUR - German Flash Services PMI

- EUR - Flash Manufacturing PMI

- EUR - Flash Services PMI

- GBP - Flash Manufacturing PMI

- GBP - Flash Services PMI

- USD - Flash Manufacturing PMI

- USD - Flash Services PMI

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.