Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Low PCE rallied the stock markets

BY Janne Muta

|July 3, 2023US equity markets had a bullish day on Friday as the May year-over-year PCE (3.85%) came in well below the previous reading of 4.344%. This marks the lowest reading since April 2021. S&P 500 rallied by over 1.0%, DJ by 0.81%, and Nasdaq and DAX gained 1.38%. Core PCE inflation remained elevated at 4.6% in May, but slightly below forecasts and the previous month's reading of 4.7%. Overall, the trend of lower inflation is consistent with the US CPI and PPI data for May.

Despite the decline, inflation levels remain substantially above the Federal Reserve's 2.0% target. It is expected that the Fed will raise rates once more and then take a data-dependent approach, likely pausing rate hikes for the rest of the year. The current probability for a 25 bp hike in June is 87.4%. The main risk event today is the US ISM Manufacturing PMI release. The US stock market will close at 8 pm MT4/5 server time (UTC+3) today and will remain closed in observance of the US Independence Day tomorrow. This is likely to dampen volatility in the markets today and tomorrow.

S&P 500

S&P 500 has reached the June 16th high at 4447. If the bulls are able to push the market decidedly above the level, the market could move further. Above 4447, the market could trade to 4480 and then possibly to 4430. If the market fails to stay above the level, look for a move to 4425 and then possibly to 4410.

However, the US equities markets are closed tomorrow for the US Independence Day celebration. Therefore, traders are likely to be cautious about pushing the market into new highs for the year just before the equities trading closes for a day. So how to trade when the market is at a key resistance level but trends higher?

While in a bullish trend, the market has a tendency to break resistance levels and honour supports major resistance levels could slow the move down or retracements. Basically, the market has three options: It can either hover around the 4447 level, start creating higher intraday lows above it or create lower highs below the level.

When it hovers and doesn’t know what to do there’s no point in trading it but if we see that there’s a continuation of the trend developing then trading the long side is the right approach to take. If, however, the market starts to show weakness we should either stay in cash and wait for the retracement to be over or look for short trade opportunities. Remember to manage the gap risk created by the market being closed. Intraday traders aren’t obviously impacted by this as they close their positions and are flat at the end of each day but swing traders need to take appropriate action.

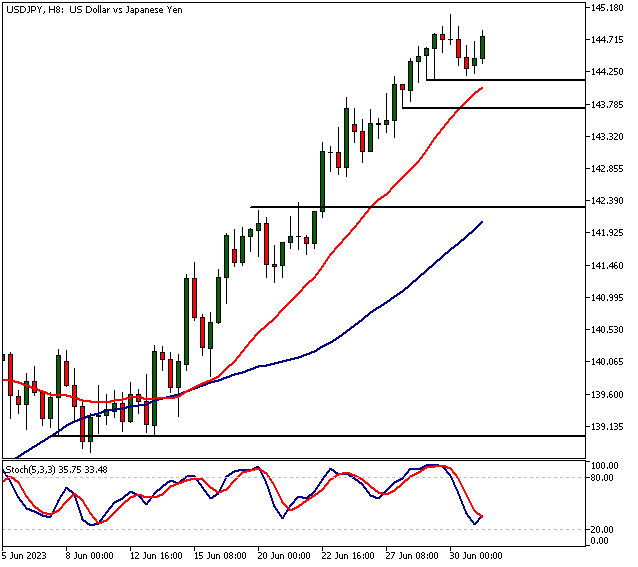

USDJPY

USDJPY remains bullish above 144.13. Above the level, look for a move to 146.10. Below 144.14, the market could move to 143.80.

CADJPY

CADJPY has been rocketing higher but last week the market stalled. This could be a sign of profit taking in the pair after the market has gained so much so quickly. Technically the uptrend is still in force as long as the 108.60 level isn’t violated. A decisive move below this level, could lead to further weakness and take the market down to 107.80 and then possibly to 107.20.

GBPJPY

GBPJPY is bullish above 182.14 and could move to 185. Below, 182.20, look for a move to 181.60.

The next main risk events

- USD ISM Manufacturing PMI

- USD ISM Manufacturing Prices

- AUD Cash Rate

- AUD RBA Rate Statement

- CNY Caixin Services PMI

- USOIL OPEC Meetings

- USD FOMC Meeting Minutes

- AUD Trade Balance

- USD ADP Non-Farm Employment Change

- USD Unemployment Claims

- USD ISM Services PMI

- USD JOLTS Job Openings

- CHF Foreign Currency Reserves

- GBP BOE Gov Bailey Speaks

- CAD Employment Change

- CAD Unemployment Rate

- USD Average Hourly Earnings m/m

- USD Non-Farm Employment Change

- USD Unemployment Rate

- CAD Ivey PMI

- EUR ECB President Lagarde Speaks

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.