Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Investors most bullish since January 2023

BY Janne Muta

|July 19, 2023Rather than buying puts to safeguard their portfolios in case of a stock market decline, investors are now betting the market rally continues and buying call options. According to data from Cboe Global Markets, the put-call ratio, which measures fear in the options market, has reached its lowest levels since January 2022.

Equities rallied higher as US retail sales indicated American consumer demand remains strong. The retail sales grew modestly by 0.2% in June 2023 compared to the previous month. This follows a revised 0.5% growth in May. However, this figure fell short of the predicted 0.5% rise. On the other hand, core retail sales, which exclude automobiles, gasoline, building materials, and food services, experienced a significant surge of 0.6%. This data indicates that US consumer remains strong and resilient.

At the same time, with 7.5% of S&P 500 companies having reported about 84% of the companies that have reported second-quarter results have exceeded analyst predictions. This is obviously a tiny sample of the companies belonging to the index but investors have clearly liked the positive indication nonetheless.

In the currency markets USD is stabilizing and GBP is falling as the UK CPI y/y came in below forecasts (7.9% vs. 8.2% expected). Markets now have to reprice the pound after expecting higher inflation for longer and more hawkishness from the BOE. Meanwhile in Australia, the minutes from the RBA’s meeting on July 4th didn’t give many clues about the future direction of monetary policy. AUD is under some pressure though as USD shows signs of stabilizing.

DAX

DAX has seen some volatility today but the market remains bullish above 15 993. Below 15 993, Dax might move to 15 880.

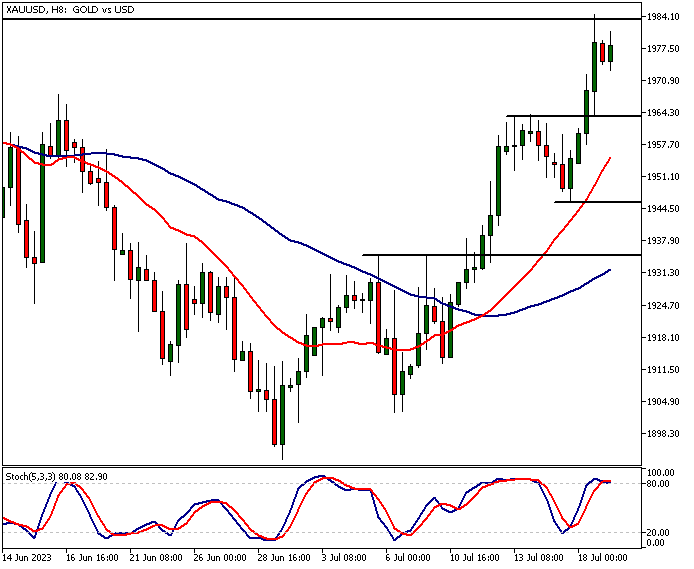

XAUUSD

Gold remains bullish above 1963.50 but has reached a resistance level at 1883.40. As a result the market has created an inside candle in the 8h chart. This indicates profit taking at the level and could make the market vulnerable for a corrective move. The nearest support (1963.50) is relatively close by though and the market has upside momentum. Therefore a complete market reversal, even though always possible, looks now unlikely. Below 1963.50, look for a move to 1948.

XAGUSD

Silver is bullish above 24.60 and could trade higher to 25.60. Below 24.60, we might see the market moving to 24.30.

USDJPY

USDJPY is trying to reverse the recent down trend. A decisive break above 139.42 would open the way to 140.50 at first and then to 142 on extension. Below, 139.42, look for a retest of last week’s low at 137.29.

The next main risk events

- AUD - Employment Change

- USD - Unemployment Claims

- USD - Philly Fed Manufacturing Index

- USD - Existing Home Sales

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.