Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

GBPUSD Technical Analysis | UK PMI trends support GBP

BY Janne Muta

|November 24, 2023GBPUSD Technical Analysis - Yesterday’s UK PMI releases showed signs of stabilization in the UK economy, with growth in the service sector offsetting a minor downturn in manufacturing.

The Flash UK PMI Composite Output Index indicated a balance between expansion and contraction. Key concerns included rising inflation in services and subdued demand. Manufacturing faced lower production and orders, while employment in services grew slightly.

Exports declined in both sectors, reflecting domestic demand gaps. The overall economic outlook was cautiously optimistic, albeit overshadowed by inflation and global uncertainties.

Analysts expect little change in US manufacturing and services PMIs for November (due today), maintaining a mix of cautious optimism and awareness of ongoing challenges like weak demand and lower business confidence.

In October, the S&P Global US Composite PMI slightly decreased to 50.7, reflecting a small increase in business activity. The Services PMI dropped to 50.6, showing modest expansion and demand recovery. Employment increased in services, and inflation rates were the lowest in three years. The Manufacturing PMI stabilized at 50.0, with a rise in orders but declining employment and business confidence.

Summary of This GBPUSD Technical Analysis Report:

- The GBPUSD has rallied over 4% since the October low, showing strong momentum on the weekly chart. This is indicated by wide-range candles and higher weekly lows. The market is approaching a minor market structure area between 1.2590 and 1.2620

- In the daily timeframe, GBPUSD is forming higher lows and higher highs, indicating that Sterling bulls are supporting the market after each retracement, expecting higher prices. However, the market is trading close to the top of the bullish channel.

- In the 8-hour chart, GBPUSD has formed a double top, suggesting potential supply above the current market price. However, the market is in a strong uptrend, as indicated by upward-pointing moving averages, and higher lows and highs on the price chart.

Read the full GBPUSD technical analysis report below.

GBPUSD technical analysis

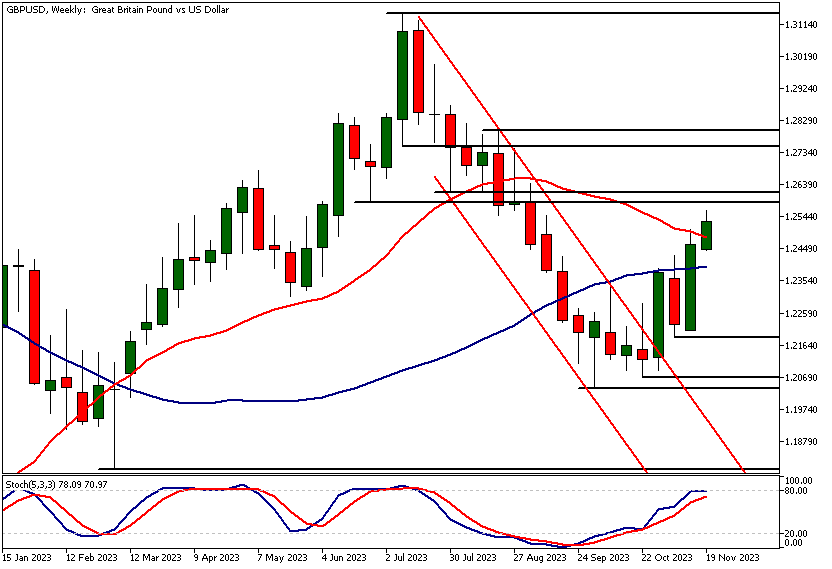

Weekly GBPUSD technical analysis

The GBPUSD has rallied over 4% since the October low, showing strong momentum on the weekly chart. This is indicated by wide-range candles and higher weekly lows.

The market is approaching a minor market structure area between 1.2590 and 1.2620. If this resistance area provokes a contra-trend retracement, we could see the market moving towards 1.2430. Alternatively, a strong push above 1.2620 would pave the way to the next market structure area at 1.2750 - 1.2800.

Indicators versus price action

Indicator-based GBPUSD technical analysis presents a mixed picture, with the 20-period moving average converging with the 50-period, while still being above it. At the same time stochastic oscillator is nearing the overbought zone. Therefore it is better to focus on price action analysis instead.

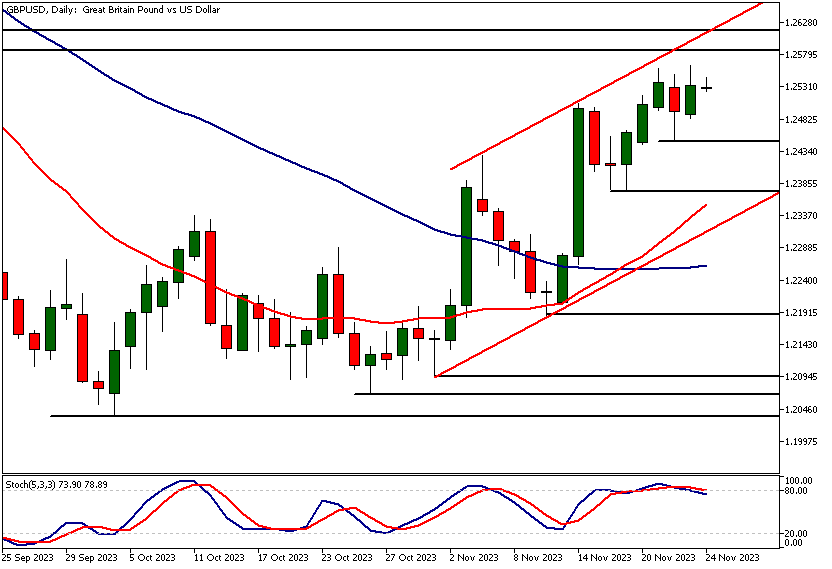

Daily GBPUSD technical analysis

In the daily timeframe, GBPUSD is forming higher lows and higher highs, indicating that Sterling bulls are supporting the market after each retracement, expecting higher prices.

However, the market is trading close to the top of the bullish channel and the market structure area (1.2750 - 1.2800) mentioned in the weekly analysis. Notably, the latest rally has been slightly weaker than the previous ones.

Bullish threshold level

If the market corrects lower, the recent low of 1.2449 could become relevant. A decisive break below this support level could lead GBPUSD to test the next key support at 1.2374. The pair remains bullish above the channel low, currently at 1.2313.

Indicator-based analysis in this timeframe indicates bullishness, with the 20-period moving average now above the 50-period, and the market trading above both. The stochastic oscillator is close to the overbought zone, typical in a bullish market.

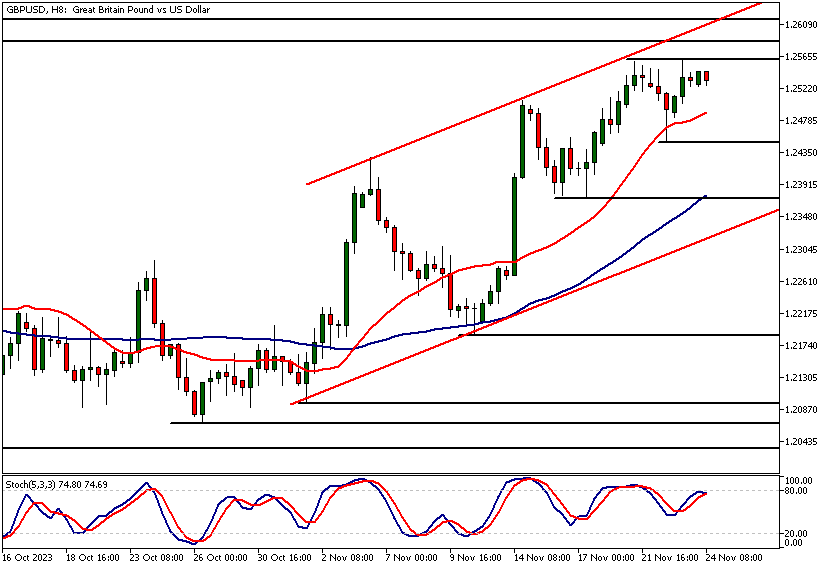

GBPUSD technical analysis, 8h chart

In the 8-hour chart, GBPUSD has formed a double top, suggesting potential supply above the current market price. However, the market is in a strong uptrend, as indicated by upward-pointing moving averages, and higher lows and highs on the price chart.

This intraday analysis is largely consistent with the daily chart, apart from the double top at 1.2559. The key price levels are the same as in the daily timeframe.

Alternative price targets

If the current upward momentum continues, the market could reach the market structure area defined in the weekly analysis, coinciding with the top of the bullish channel. If the market fails to rally decisively above 1.2559, a retest of the nearest support level at 1.2449 is likely. Below this level, the market could move down to 1.2417.

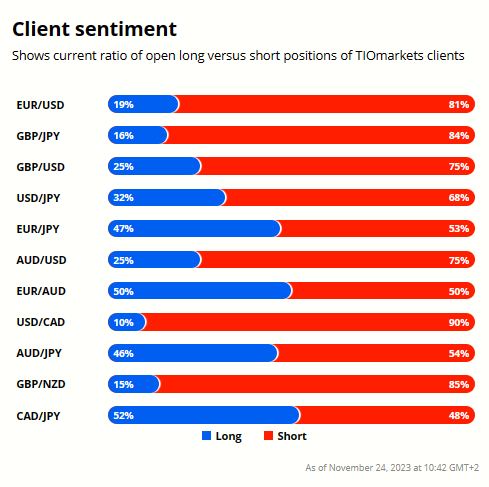

Client sentiment analysis

TIOmarkets' clients are bearish with 75% holding a short position and 25% holding long positions in GBPUSD.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market

- USD - Flash Manufacturing PMI

- USD - Flash Services PMI

- USD - New Home Sales

- USD - S&P/CS Composite-20 HPI

- USD - CB Consumer Confidence

- USD - Richmond Manufacturing Index

- USD - FOMC Member Waller Speaks

- USD - Prelim GDP

- USD - Prelim GDP Price Index

- GBP - BOE Gov Bailey Speaks

- USD - Core PCE Price Index

- USD - Unemployment Claims

- USD - Chicago PMI

- USD - Pending Home Sales

- USD - ISM Manufacturing PMI

- USD - ISM Manufacturing Prices

- USD - Fed Chair Powell Speaks

Potential GBPUSD Market Moves

The market is approaching a minor market structure area between 1.2590 and 1.2620. If this resistance area provokes a contra-trend retracement, we could see the market moving towards 1.2430. Alternatively, a strong push above 1.2620 would pave the way to the next market structure area at 1.2750 - 1.2800.

How would you trade the GBPUSD today?

I hope this fundamental and technical GBPUSD analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

TIO Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.