Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Fitch Downgrades US to AA+

BY Janne Muta

|August 2, 2023Fitch has downgraded the US long-term debt from AAA to AA+. The decision comes as a consequence of the debt ceiling debacle and the mounting governance difficulties that have plagued the nation. Fitch had warned about the possible rating cut in May. Risky assets are struggling with the major equity indices trading lower and commodity currencies losing ground. Gold is trading at a support level and USDJPY corrects lower at the time of writing this.

This downgrade caused some concern among the bondholders. The 10-year government bond yield climbed to 4.048% (bonds were sold). The move could raise borrowing costs for the government and businesses.

The ISM Manufacturing PMI came in once again well below the crucial 50 level (46.4, 46 prior). US manufacturing activity has remained in contraction territory for the ninth consecutive month.

On the employment front, the JOLTS report shows a slight decline in job openings in June, standing at a seasonally adjusted 9.6 million. This decline could be a reflection of businesses adopting a cautious approach amid uncertainties surrounding the global economic environment. Markets are closely watching for the upcoming job data, particularly the wage growth figures, as they play a significant role in influencing services inflation.

In the currency markets, the New Zealand dollar has struggled, with the Q2 employment report revealing higher unemployment than in Q1 and above consensus expectations. The currency is selling off as the numbers could be a sign of wider economic vulnerabilities. In Japan, the latest meeting minutes show that members of the BOJ agreed to maintain the current monetary easing.

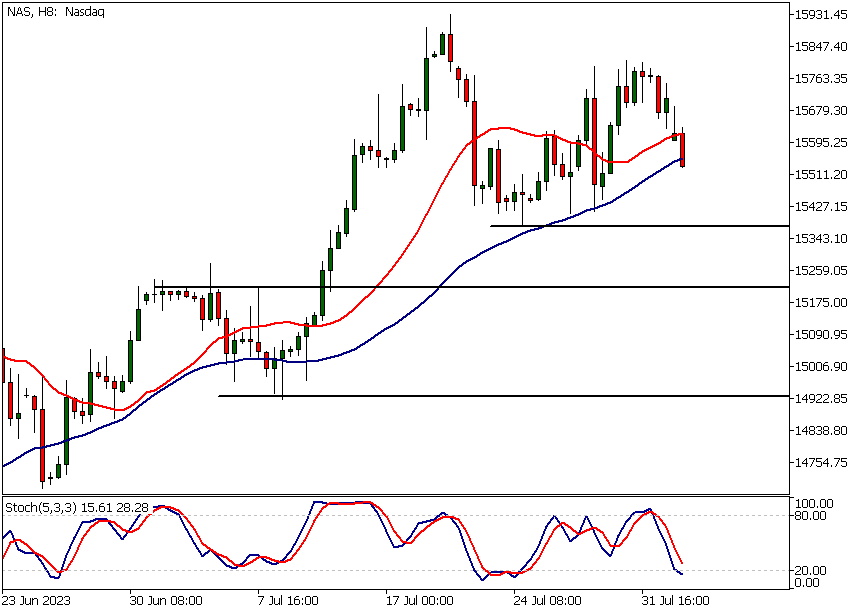

NAS

Nasdaq has created a lower swing high at 15 787 and is currently trading lower towards the 15 373 support level. If the support level holds, the market could challenge the 15 787 again. Below 15 373, look for a move to 15 226 and then possibly to 14 950 on extension.

USDCAD

USDCAD remains bullish above 1.3264. Below the level, look for a move to 1.3200 or so.

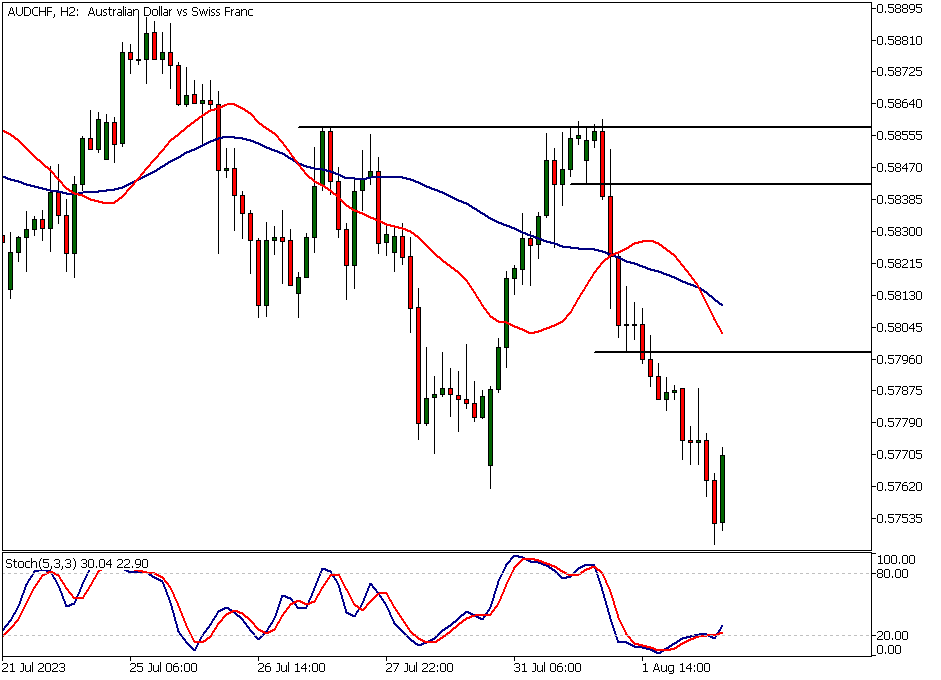

AUDCHF

AUDCHF is bearish below 0.5800. Above the level the market could move to 0.5850.

USDJPY

USDJPY is reacting lower but remains bullish if it can maintain levels above 141.95. If the level is broken decisively look for a move to 141.32.

The next main risk events

- AUD - Trade Balance

- CNY - Caixin Services PMI

- CHF - CPI

- USOIL - OPEC JMMC Meetings

- GBP - BOE Monetary Policy Report

- GBP - MPC Official Bank Rate Votes

- GBP - Monetary Policy Summary

- GBP - Official Bank Rate

- GBP - BOE Gov Bailey Speaks

- USD - Unemployment Claims

- USD - ISM Services PMI

- AUD - RBA Monetary Policy Statement

- CAD - Employment Change

- CAD - Unemployment Rate

- USD - Average Hourly Earnings m/m

- USD - Non-Farm Employment Change

- USD - Unemployment Rate

- CAD - Ivey PMI

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.