Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

EURUSD Technical Analysis | Dollar under pressure as the Core CPI is cooling down

BY Janne Muta

|November 14, 2023EURUSD Technical Analysis - US inflation for October showed signs of cooling, with the headline consumer prices rising at a slower pace of 3.2% (3.3% expected, 3.7% prior). The Federal Reserve is expected to maintain the current rate level in its December meeting and cut rates four times, starting in May 2024 .

This slowdown in inflation, particularly in core prices, has reduced recession risks and positively boosted market confidence. With the US 2 year and 10 year yields dropping sharply the EURUSD has rallied substantially after the CPI announcement.

Summary of This EURUSD Technical Analysis Report:

- The weekly chart indicates an upward trend in Euro USD, potentially reaching 1.0920, with possible resistance at two market levels and a trendline; a fallback to 1.0640 is also possible but given the strong upside momentum and declining US yields it seems less likely.

- EURUSD has been trending upward since October, following a strong rally after a lower than expected US core CPI reading today. The currency pair is now above the 50-period moving average, indicating a reversal from its previous downtrend, with key resistance at 1.0945 and support at 1.0716.

- EURUSD is trading within a bullish trend channel on the 8-hour chart, with potential to reach 1.0880 if current momentum continues. Should it retrace, key support levels at 1.0756 and 1.0706, the latter aligning with the 20-period moving average and channel low, EURUSD might attract buyers.

Read the full EURUSD technical analysis report below.

EURUSD Technical Analysis

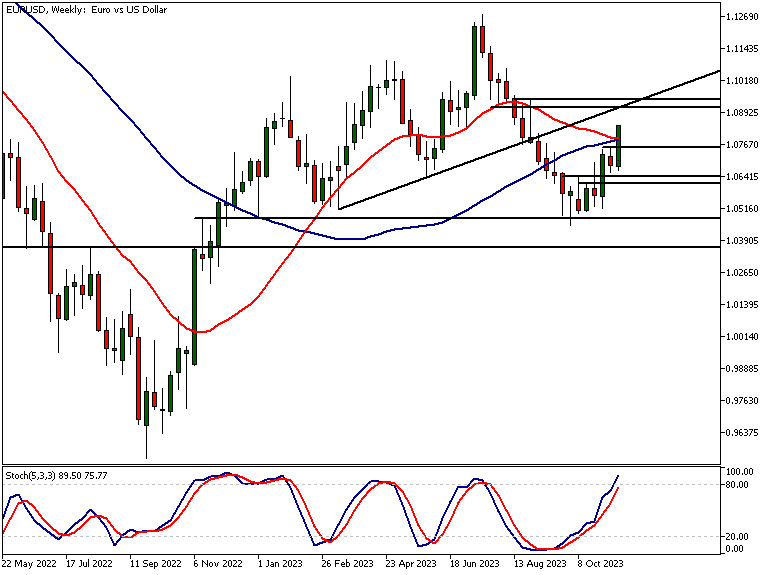

Weekly EURUSD Technical Analysis

The weekly chart shows the Euro USD trending higher after it broke above the base high at 1.0640 two weeks ago. Above 1.0640, we could see the market trading to 1.0920 or so. This is where two market structure levels and trendline resistance are closely aligned. Should the current momentum fail before this, a retest of 1.0640 could take place.

Daily EURUSD Technical Analysis

EURUSD started creating higher swing lows after the market attracted buying at 1.0448 in October. Following the lower than expected core CPI reading from the US, the market rallied strongly.

This was a natural continuation after we saw the market creating higher swing lows above the 1.0448 level. With the market trading strongly higher above the 50-period moving average, EURUSD technical analysis indicates that the market has reversed the previous downtrend and is now trending higher.

Nearest key price levels

The nearest major resistance level on the daily chart is at 1.0945, while the nearest support level on the daily chart can be found at 1.0716. Should the level fail to provide support in the event of the market retracing lower, we could see EURUSD moving down to the next support level at the latest higher swing low (1.0656).

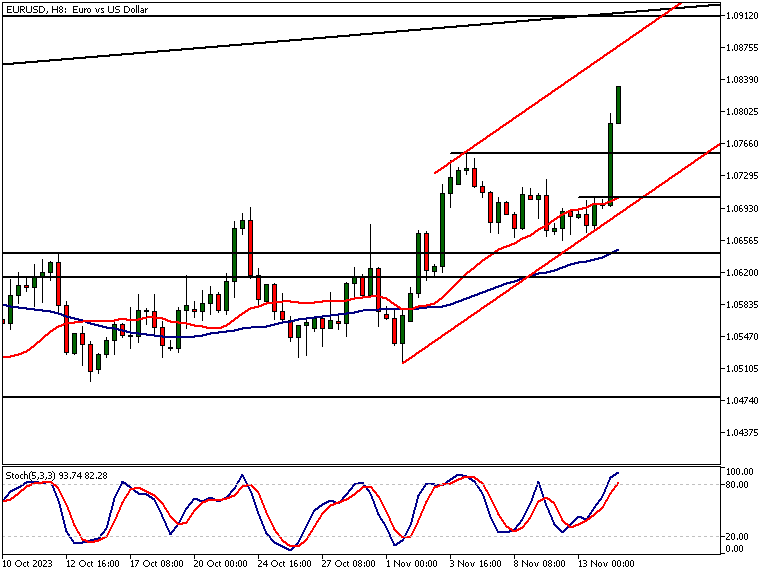

EURUSD Technical Analysis, 8h Chart

If the upside momentum is sustained, the market could trade to the trend channel high at 1.0880 and then perhaps to 1.0920 on extension.

However, in the case of the market retracing lower, EURUSD could retest one or more support levels inside the bullish trend channel. The first one is a penetrated swing high at 1.0756, and the one below that is a market structure level at 1.0706.

Technical confluence

Our EURUSD technical analysis reveals that the latter support level coincides with the 20-period moving average and is closely aligned with the bullish channel low. Therefore, in the case of the market retracing to this level, we could see buyers re-engaging with the market again.

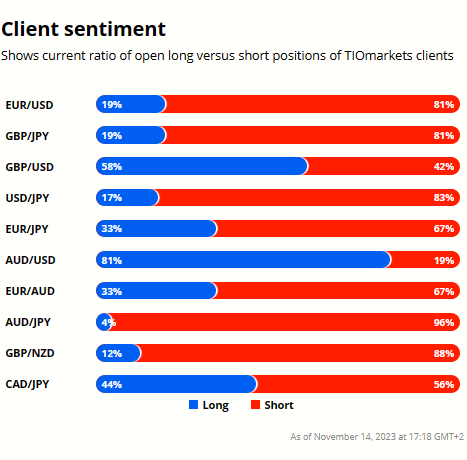

Client sentiment analysis

TIOmarkets' clientele are very bearish on EURUSD , with 81% of clients holding short positions and only 19% favouring the long side.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market:

- USD - Empire State Manufacturing Index

- USD - PPI

- USD - Retail Sales

- USD - Unemployment Claims

- EUR - ECB President Lagarde Speaks

Potential EURUSD Market Moves

If the upside momentum is sustained, the market could trade to the trend channel high at 1.0880 and then perhaps to 1.0920 on extension. However, in the case of the market retracing lower, EURUSD could retest one or more support levels inside the bullish trend channel. The first one is a penetrated swing high at 1.0756, and the one below that is a market structure level at 1.0706.

How would you trade the EURUSD today?

I hope this EURUSD technical analysis report helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.