Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

EURAUD technical analysis | Daily Bearish Shooting Star

BY Janne Muta

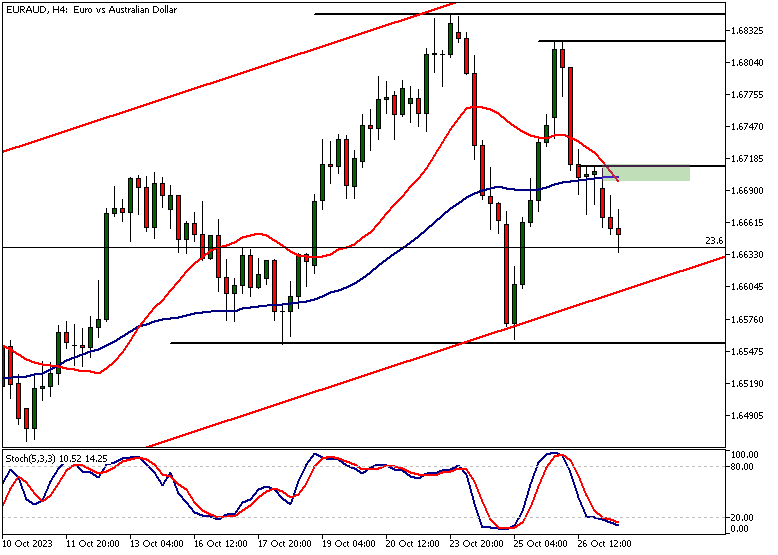

|October 27, 2023EURAUD technical analysis reveals the market in a weekly uptrend. However, the ECB decided yesterday to put the rate hikes on hold weakening Euro against the AUD. As a result, the market created a bearish shooting star candle in the daily chart yesterday.

Australia's Q3 2023 PPI

Australia's Q3 2023 producer price index rising 1.8%, up from 0.5% in Q2 could be putting further pressure on Euro against the AUD. The bearish shooting star candle from yesterday could turn into a lower swing high.

Further Consolidation Ahead?

If the market closed below yesterday's low today the market could have further consolidation ahead before the uptrend in the weekly and daily charts can continue.

Summary of this EURAUD technical analysis report

- Bullish momentum in the weekly chart, EURAUD has rallied 9% since January.

- The market remains bullish above the key support level at 1.6321

- ECB's rate hike pause weakened the pair

- Australia's rising Q3 producer price index pressures Euro against AUD

Read our full EURAUD technical analysis report below.

EURAUD Technical Analysis

EURAUD Technical Analysis, Weekly

Since the January low this year EURAUD has rallied approximately 9%. The market has been creating higher lows and higher highs in the weekly chart indicating that the bulls are in charge of this market. The latest weekly swing low at 1.6321 is the key support level for the trend continuation. Above this swing low, the market remains bullish in the weekly chart.

Technical Factors and Levels

The 1.6321 swing low roughly coincides with the 38.2 Fibonacci retracement level. This retracement level at 1.6386 is also fairly closely aligned with the bullish channel low, currently at 1.6436. With so many technical factors aligning within the price range of 1.6321-1.6436, it is safe to assume that this price range is closely followed by a large number of traders. This adds to the significance of this price area.

Potential Market Moves

Therefore if the bulls are ready to defend levels above 1.6321 and maintain the upward momentum we should look for a move to the August high at 1.7066. Alternatively, a decisive break below 1.6321 would be likely to reverse the uptrend and we might see EURAUD trading down to the 61.8 Fibonacci retracement level.

Indicator-Based Analysis

Indicator based you are AUD technical analysis reveals the market in a strong uptrend with the 20 period moving average above the 50 period moving average and both moving averages pointing higher. The stochastic oscillator is about to move to overbought territory. In this context, the indication however might not be that significant.

EURAUD Technical Analysis, Daily

EURAUD technical analysis in the daily time frame chart reveals another bullish trend channel. This channel was created after the market bounced higher from 1.6321 at the end of September.

Recent Volatility Observations

Over the last 4 days, there has been increased volatility in the daily time frame chart. This has led to the market retesting the 1.6553 support level. Yesterday's lower high could be an indication that this level gets tested again.

Potential Market Scenarios

Above 1.6553 look for a move to 1.6893 and then to 1.7066 on extension. Alternatively, if 1.6553 does not hold the market could trade down to the 1.6321-1.6436 conference area we referred to in the weekly EURAUD technical analysis.

The 4-hour chart shows the EURAUD finding support at the daily bull channel low. At the time of writing this, the market is trying to trade higher from a confluence level where the bullish channel low and the 23.6% Fibonacci retracement level (1.6644) are closely aligned.

Stochastic Oscillator Insights

The stochastic oscillator is in the oversold territory and together with the market bouncing higher from a support level suggests that the market could be turning higher.

Potential Market Movements

In order to create a sustained rally, the market needs to penetrate the 1.6712 level decisively. This would open the way to 1.6820 and then possibly further. If this reversal attempt fails look for a retest of 1.6553.

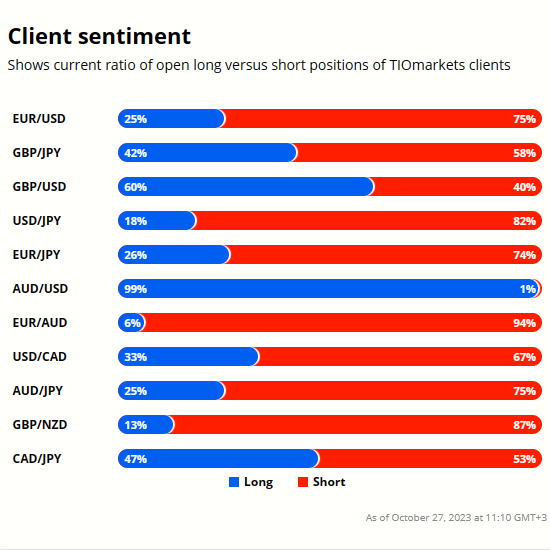

Client sentiment analysis

TIOmarkets clients are extremely bearish on EURAUD with 94% of clients holding short positions and 6% holding long positions in the market.

Please remember that the retail trader client sentiment is a contrarian indicator as most of the retail traders are on average betting against the market trends. This is why, experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The Next Key Risk Events

- Australian Retail Sales

- German Inflation Rate

- RBA Jones Speech

- German GDP Growth Rate

Potential bullish and bearish scenarios for EURAUD

EURAUD has rallied 9% since January, showcasing a dominant bullish trend. The market remains bullish above 1.6321, potentially pushing the market towards the key 1.7066 resistance.

On the other hand, the ECB's decision to pause rate hikes coupled with Australia's robust producer price index may weaken the Euro against the AUD. The appearance of a bearish shooting star candle suggests possible trend reversals or consolidation. If the market drops below the 1.6321 support, we might see a slide towards the 61.8 Fibonacci retracement level (1.5944).

How would you trade EURAUD today?

I hope this fundamental and technical analysis of EURAUD helps you make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.