Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

ECB to follow the Fed today?

BY Janne Muta

|July 27, 2023Fed raised interest rates to 5.25%-5.5%, the highest since 2001 as the central bank aims to combat inflation. Fed Chair Jerome Powell emphasized vigilance, keeping options open, and assessing inflation, employment, and economic growth data for future decisions. The rate hike was unanimous. Markets expect this to be the last hike, with the Fed cutting rates in May. Powell, however, pointed out that monetary policy depends on future economic data. Powell hinted that rates may remain elevated until inflation gradually subsides.

Gold rallied higher as Fed's statement lacked clear guidance on future rate hikes and traders expect the rates to move lower over the next 12 months. The dollar weakened after the announcement which helped gold bulls in bidding the market higher. This could be the last rate hike of the cycle, given falling inflation and a weaker labour market. If the rate hike cycle has peaked, we should see bullish sentiment for gold to continue as it factors in potential future rate cuts.

EURUSD drifted lower last week, but yesterday the euro once again strengthened against the dollar as the EURUSD pair tries to resume its upward trend in the daily timeframe. The anticipated 25 basis point rate hike by the ECB is likely already priced in, limiting its potential impact on the market strongly today. As a result, traders’ attention will be on the ECB press conference, where President Lagarde's remarks on future monetary policy will be crucial in determining the pair's direction.

EURAUD

EURAUD is trading inside a wide range between 1.6235 and 1.6602. The market has however created two lower swing highs in the 8h chart. This might lead to the market breaking below the range low. If there's a decisive break below 1.6235, look for a move to 1.6050 or so. Above 1.6235, the market could rally to 1.6460.

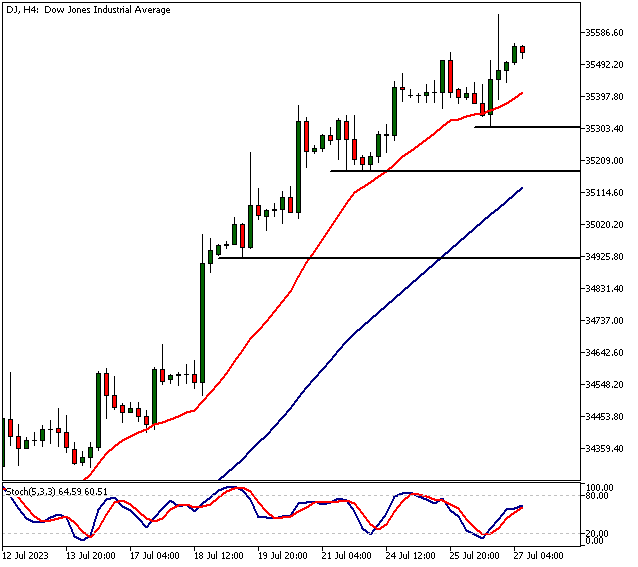

DJ

DJ is bullish above 35 311. Below the level, the market could move to 35 267 and then perhaps to 35 182 on extension. Keep an eye on price action following the US advance GDP and the core PCE releases today and tomorrow to see if the momentum stays strong or whether the key supports get violated. The nearest major resistance level is at 36 971.

Gold

Gold is bullish above 1963.90. Below the level, the market might move down to 1958. The nearest key resistance level is at 1987.50.

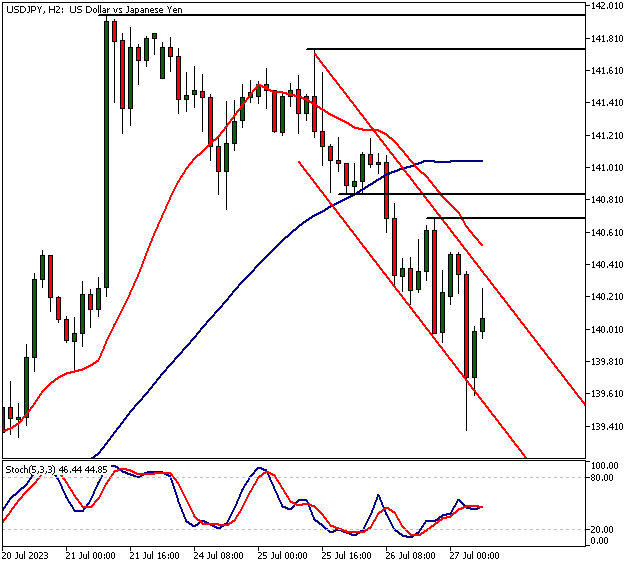

USDJPY

USDJPY is trending lower in the 2h timeframe. The trend stays in force below 140.70 and could move the market lower to 138.80. Above 140.70, USDJPY would be likely to trade to 141.85.

The next main risk events

- EUR Main Refinancing Rate

- EUR Monetary Policy Statement

- USD Advance GDP

- USD Unemployment Claims

- EUR ECB Press Conference

- JPY Tokyo Core CPI

- JPY BOJ Outlook Report

- JPY Monetary Policy Statement

- JPY BOJ Policy Rate

- EUR German Prelim CPI

- JPY BOJ Press Conference

- EUR Spanish Flash CPICAD GDP

- USD Core PCE Price Index

- USD Employment Cost Index

- USD Revised UoM Consumer Sentiment

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.