Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Earnings beat expectations

BY Janne Muta

|August 1, 2023The US stock market has seen a months-long rally, showing signs of widespread strength across various sectors. Smaller regional banks and the largest technology companies alike have benefitted from the upward trend, indicating investor confidence in the continuous growth of the US economy. Notably, a significant 81% of companies have exceeded earnings estimates. This is the highest figure in almost two years. The quarterly reports from tech giants Apple and Amazon later this week are eagerly anticipated by traders and investors alike.

Fed Fund Futures traders do not expect any more rate hikes from the Federal Reserve. Instead, they are placing their bets on the central bank starting rate cuts in March 2024.

The T-Bond market traded slightly higher yesterday, resulting in lower yields and supporting the gold market. However, despite the lower yields the USD still gained ground against the JPY, EUR, and GBP. On the other hand, commodity currencies traded higher, following the lead from the USOIL.

The rise in oil prices, if sustained, could eventually raise concerns about inflation, leading to speculation about the Federal Reserve's response in raising or maintaining higher interest rates. Crude oil prices traded higher again yesterday as traders anticipate supply cuts by Saudi Arabia and Russia, aiming to tighten global supplies.

In the US, investors have priced in a soft landing scenario. Therefore, all eyes are on the upcoming NFP data. Investors want to see the strength of the jobs market to understand if the market pricing of the soft landing scenario is correct. Meanwhile, in the UK, the Bank of England's rate decision is another key event that market participants will be watching closely.

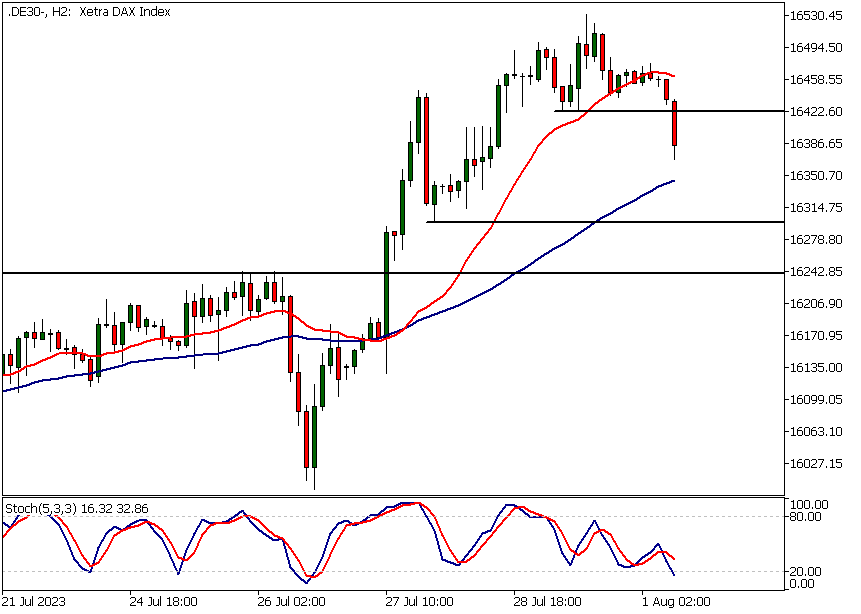

DAX

DAX has reached new all time highs and lost some momentum. Yesterday's close was near to the open reflecting bulls' inability to push the price to a significantly higher close. As the 16 423 support has now broken, the market might trade down to 16 334 or so. Above 16 423, look for a move to yesterday's high (16 531) and possibly beyond it.

FTSE

After rallying strongly FTSE has traded sideways for several days. The market has created higher lows though suggesting the bulls want to push the market higher still. FTSE remains bullish above 7655. If the level is violated the market could move to 7628. Above 7655, the uptrend will stay in force and we might see a move beyond the 7723 resistance.

USDJPY

USDJPY remains in 2h uptrend above 142. Below the level, the market might trade down to 141.16.

USDCAD

USDCAD is building a base. If we see a decisive breakout from the base the market might move significantly higher. A decisive move beyond 1.3261 could open the way to 1.3302 and then if the market stays strong possibly to 1.3380. If the 1.3261 level can't be penetrated look for a move to 1.3146 and possibly below.

The next main risk events

- USD ISM Manufacturing PMI

- USD JOLTS Job Openings

- USD ISM Manufacturing Prices

- NZD Employment Change

- NZD Unemployment Rate

- USD ADP Non-Farm Employment Change

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 82% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: Tio Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.