Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

DAX Technical Analysis | Will ECB's hawkish rates stance lead to a market correction?

BY Janne Muta

|December 15, 2023Dax technical analysis - The Dax traded lower yesterday after the ECB decided to maintain interest rates at a historically high levels. The main refinancing operations rate remains at 4.5%, and the deposit facility rate is at 4%. Additionally, the ECB noted the central bank would maintain rates at sufficiently restrictive levels for as long as necessary.

The German PMI reports for December (released today) indicate a continued contraction in the private sector. The Composite PMI Output Index fell to 46.7, marking a two-month low. Both manufacturing and services sectors experienced faster declines in activity, with manufacturing output at a two-month low of 43.4 and services business activity at 48.4.

Inflationary pressures intensified, with a notable rise in output prices, the steepest in seven months. Employment declined for the fourth consecutive month, reflecting reduced workloads and efforts to cut overheads. Despite these challenges, there was a slight improvement in business expectations, although overall sentiment remained low due to economic and political uncertainties.

Summary of This Dax Technical Analysis Report:

- The DAX has reached a trendline resistance from a summer-formed widening top, with potential retracement risk increasing if momentum loss continues today. Nearest supports are at 16,044 and 16,531 while the nearest resistance is at 17,003.

- Following daily a bearish engulfing candle, the DAX risks a corrective move below the previous day's low. A break above 17,003 could target 17,160, while a fall might reach 15,390.

- Within an ascending trend channel, the DAX shows bullish signs. Breaking above yesterday's high seems likely if the market stays within the bullish trend channel. However falling below the channel the market could drop towards 16,260.

Read the full Dax Technical Analysis report below.

Dax Technical Analysis

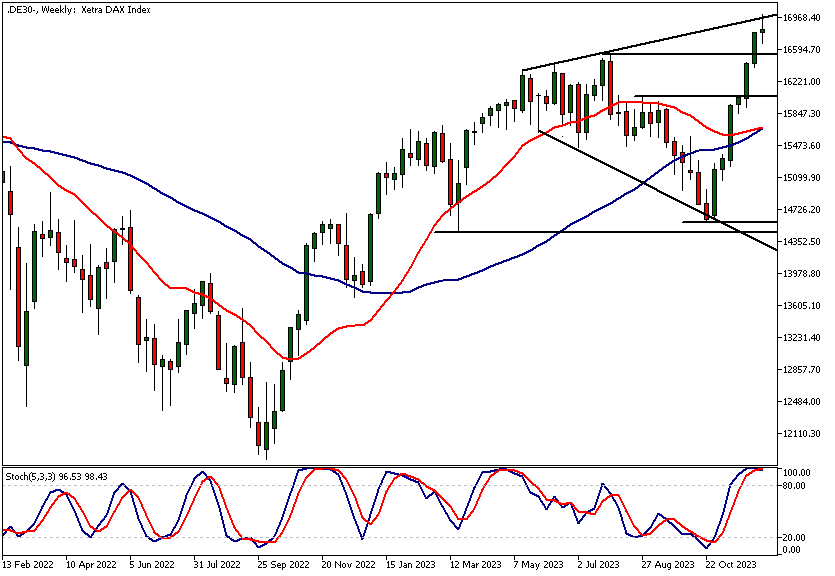

Weekly Dax Technical Analysis

The Dax has rallied to a trendline resistance. This trendline originates from the widening top formation created in the summer. Simultaneously, the stochastic oscillator is indicating a loss of momentum.

The nearest weekly support levels are at 16,044 and 16,531, while the nearest resistance can be found at this week's high (17,003). Note how it coincides with the upward sloping trendline resistance suggesting the level is technically quite significant.

Moving average-based Dax technical analysis indicates long-term bullishness, but as the market is quite extended and at a resistance level, a retracement lower is possible.

Daily Dax Technical Analysis

Yesterday, the DAX closed below the previous day's low, creating a bearish engulfing candle. With the candle's high at the upward-sloping resistance, this pattern alerts to an increased risk of a corrective move lower. If the market cannot move above yesterday's high (17,003) today or early next week, a move down to 16,560 could be likely.

In case there is a deeper contra-trend move, look for a move to around 15,390. Alternatively, a strong rally above the 17,003 high could push the market to approximately 17,160. Dax technical analysis with moving averages indicates that the upward trend is still intact, and the long-term market bias therefore remains bullish.

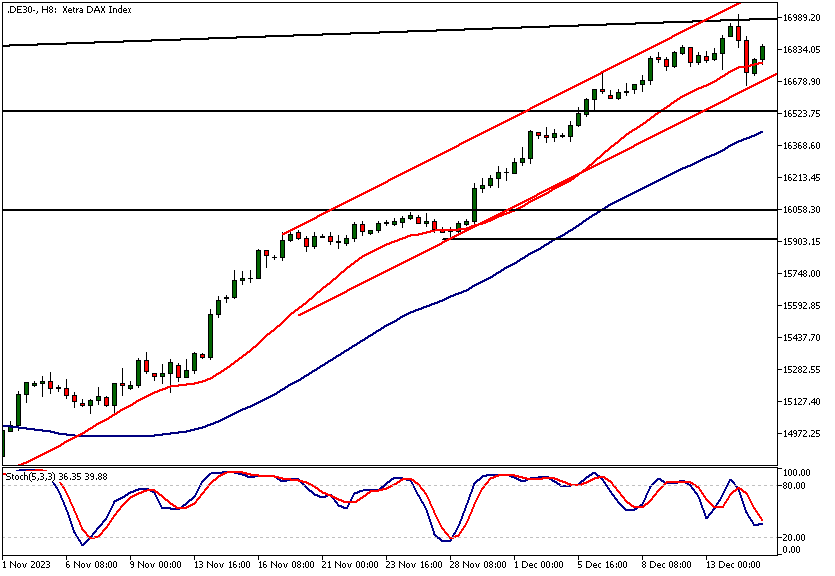

Intraday Dax Technical Analysis

In the 8-hour chart, the market is still inside an ascending trend channel. This is a bullish indication and is supported by moving average-based Dax technical analysis. The SMA(20) is above the SMA(50), and both averages point higher, suggesting a bullish bias.

While inside the channel, the market is likely to break above yesterday's high. However, if the market breaks below the channel's low, Dax technical analysis suggests the market could trade down to a 16,260 measured move target.

Client sentiment analysis

63% of clients trading DAX are holding long positions, while 37% are holding short positions. Client sentiment data is being provided by TIO Markets Ltd.

It’s good to remember that retail client trading sentiment is a contrarian indicator as most retail traders are on average trading against market price trends. This is why experienced traders tend to trade against the retail client sentiment. You can follow the TIOmarkets client sentiment live on our Forex dashboard.

The next key risk events impacting this market

- US Empire State Manufacturing Index

- US Industrial Production m/m

- US Flash Manufacturing PMI

- US Flash Services PMI

- German IFO Business Climate

Potential Dax Market Moves

In a bullish scenario, the DAX could break above its current resistance at 17,003, potentially leading to a rally towards 17,160. Conversely, a bearish outcome might see the index failing to surpass 17,003 and retreating to lower price targets at 16,560 or and then perhaps to 15,390 on extension.

How would you trade the Dax today?

I hope this Dax technical analysis helps you to make better informed trading decisions. Check the latest market analysis for other instruments and subscribe to receive them in your inbox as soon as they are published

While research has been undertaken to compile the above content, it remains an informational and educational piece only. None of the content provided constitutes any form of investment advice.

TIO Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorised and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIO Markets offers an exclusively execution-only service. The views expressed are for information purposes only. None of the content provided constitutes any form of investment advice. The comments are made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.