Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

BOE hikes 50 bp

BY Janne Muta

|June 23, 2023Yesterday the Bank of England (BOE) took the markets by surprise with a 50 basis points rate adjustment, taking the bank rate to 5.00%. This was prompted by Wednesday’s higher-than-anticipated inflation report. GBPUSD didn’t rally but instead traded lower. GBPAUD, however, was bid higher and remains bullish due to monetary policy divergence. The UK retail sales for May came in quite strong: 0.3% m/m vs. -0.2% m/m expected. Heads up for PMI number releases from the main EU economies and the US.

In Japan, May's "core-core" index rises by 4.3%. The increase is the highest since 1981. Ultra-dovish BOJ policies keep the JPY weak against the dollar but high inflation could at some point force the central bank to drop the ongoing support to the economy. At the moment though USDJPY remains bullish. USDCAD and AUDUSD are bearish below 1.3270 and 0.6770 respectively, influenced by BOC's hawkishness and RBA's rate stance.

In yesterday’s equity markets trading, the S&P 500 (0.38%) and Nasdaq (1.37%) closed higher, while the Dow Jones (-0.07%), DAX (-0.17%) and FTSE (-0.38%) ended the day lower. During his semi-annual report to Congress, Federal Reserve Chair Jerome Powell emphasized the Fed's commitment to combating inflation.

Powell's testimony suggested that it is reasonable to expect two more interest rate hikes in 2023. Markets are placing a 76% probability for a quarter-point rate hike in July. Treasury yields moved higher. The yield curve (the difference between the 2-year and 10-year Treasury yields) remains inverted. Historically this has indicated a recession in the US economy. Rising yields have kept the price of gold under pressure.

USDCAD

USDCAD is bearish below 1.3270. Above the level, the market could rally to 1.3320. CAD appreciates even though the price of oil slips lower. The BOC’s hawkish stance (more rate hikes could be ahead) supports the currency. Note, however, that the market has lost downside momentum. The weekly candle is still fairly narrow-bodied indicating a lack of selling pressure.

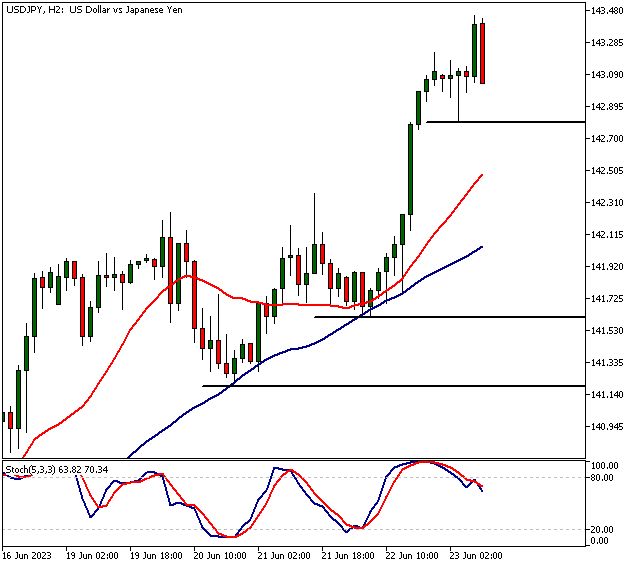

USDJPY

USDJPY is bullish above 142.80. Below the level, look for a move to 142.30. Ultra-dovish BOJ policies keep the JPY weak against the dollar. High inflation could at some point force the central bank’s hand though. In May, the "core-core" index, (excludes the influence of fresh food and fuel), rose by 4.3%, surpassing the 4.1% increase in April and marking the largest surge since June 1981.

AUDUSD

AUDUSD is bearish below 0.6770. Above the level, we might see a move to 0.6800. AUD remains bearish after the RBA indicated it might not be hiking rates in the near future.

GBPAUD

GBPAUD is bullish above 1.8835. Below the level, a move to 1.8780 would be likely. Monetary policy divergence between the BOE and RBA continues to push the currency pair higher.

The next main risk events

- EUR - French Flash Manufacturing PMI

- EUR - French Flash Services PMI

- EUR - German Flash Manufacturing PMI

- EUR - German Flash Services PMI

- EUR - Flash Manufacturing PMI

- EUR - Flash Services PMI

- GBP - Flash Manufacturing PMI

- GBP - Flash Services PMI

- USD - Flash Manufacturing PMI

- USD - Flash Services PMI

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.