Risk disclaimer: 76% of retail investor accounts lose money when trading CFDs and Spreadbets with this provider. You should consider whether you understand how CFDs and Spreadbets work and whether you can afford to take the high risk of losing your money.

Be ready to trade the FOMC Minutes

BY Janne Muta

|July 5, 2023Caixin Services PMI declined but remained above the crucial 50 level. The services sector remains in expansion. Today’s main risk event is the FOMC Meeting Minutes. The Fed Fund Futures traders are currently pricing an 88.7% probability for a 25 bp hike in June. The markets, therefore, take it for granted that the rates do go higher at least one more step before the Fed is expected to pause.

If the meeting minutes reveal something else that’s likely to create additional volatility and trading opportunities for us. Surprises in the minutes would be especially likely to move Nasdaq and the USDJPY so keep an eye on these markets.

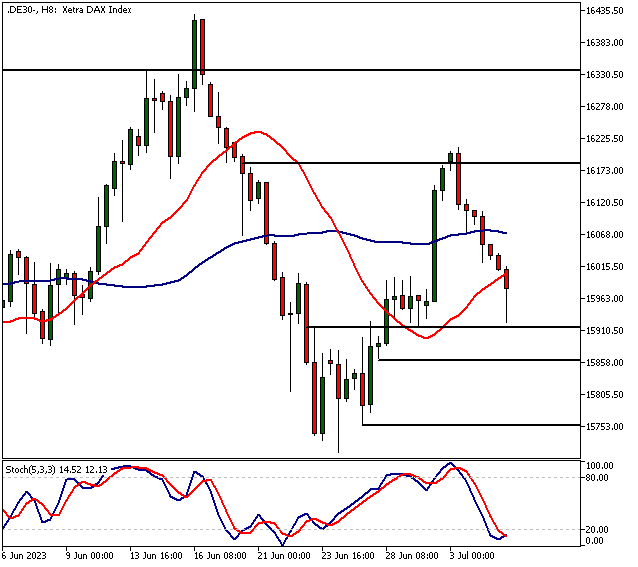

DAX

After rallying strongly DAX has now retraced for two days and has now reached the levels where the rally started. This is a potential level for the market to attract buyers but before we see it happening we should remain patient and not jump the gun. At the time of writing this, there has been a a reaction to the support level, but we don't know yet if this turns to a proper market reversal. Monitor DAX to see if there are more signs of strength.

So trade what you see, not what you expect. Long trades are warranted if you see the buyers engaging the market. Institutional traders buy weakness because they have to due to the vast position sizes they have to accumulate. Retail traders, however, don’t have this problem and can wait and buy only when they see institutional money flows turning the market bullish. If the market doesn’t turn bullish, look for a move to 15 600.

Nasdaq

For the last two days, the Nasdaq CFD (NAS) has been consolidating below the June high (15 282). Now there's some weakness and the market has broken the 15 154 support level. Below 15 154, look for a move to 15 100 or so and then possibly to 15 020 on extension. Above 15 154, the uptrend is still on and the market could test the June high at 15 300.

Nasdaq being a growth company index is sensitive to the market expectations on the future interest rates. The future cost of financing impacts the future cash flow valuations of these companies. Therefore today’s FOMC Meeting Minutes could have a substantial impact on how willing the Nasdaq bulls are to overcome the supply often available at previous key resistance levels.

USDJPY

USDJPY remains bullish above 144.00 and is likely to test the 145.00 resistance. A decisive break below 144.00 could move the market down to 143.30. The continued monetary policy divergence between the Fed and the BOJ supports the dollar against the Yen.

NVDA

Nvidia remains bullish above 375. The market has created a new higher swing low in the daily chart (at 400). The stock has rocketed higher since we highlighted its AI-related potential in May. The stock trades now over 25% higher than at the time of our report. Nvidia remains a leader among the AI stocks and could have more upside potential. But, once again: Trade only what you see, not what you expect! . A break below 400 would probably move the stock down to 375. A decisive break below 375 would mean the stock isn’t anymore attracting new buyers

The next main risk events

- USOIL OPEC Meetings

- USD FOMC Meeting Minutes

- AUD Trade Balance

- USD ADP Non-Farm Employment Change

- USD Unemployment Claims

- USD ISM Services PMI

- USD JOLTS Job Openings

- CHF Foreign Currency Reserves

- GBP BOE Gov Bailey Speaks

- CAD Employment Change

- CAD Unemployment Rate

- USD Average Hourly Earnings m/m

- USD Non-Farm Employment Change

- USD Unemployment Rate

- CAD Ivey PMI

- EUR ECB President Lagarde Speaks

For more information and details see the TIOmarkets economic calendar.

Trade Safe!

Janne Muta

Chief Market Analyst

TIOmarkets

Tio Markets UK Limited is a company registered in England and Wales under company number 06592025 and is authorized and regulated by the Financial Conduct Authority FRN: 488900

Risk warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Professional clients can lose more than they deposit. All trading involves risk.

DISCLAIMER: TIOmarkets offers exclusively consultancy-free service. The views expressed in this blog are our opinions only and made available purely for educational and marketing purposes and do NOT constitute advice or investment recommendation (and should not be considered as such) and do not in any way constitute an invitation to acquire any financial instrument or product. TIOmarkets and its affiliates and consultants are not liable for any damages that may be caused by individual comments or statements by TIOmarkets analysis and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his/her investment decisions. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances, or needs. The content has not been prepared in accordance with any legal requirements for financial analysis and must, therefore, be viewed by the reader as marketing information. TIOmarkets prohibits duplication or publication without explicit approval.

Janne Muta holds an M.Sc in finance and has over 20 years experience in analysing and trading the financial markets.